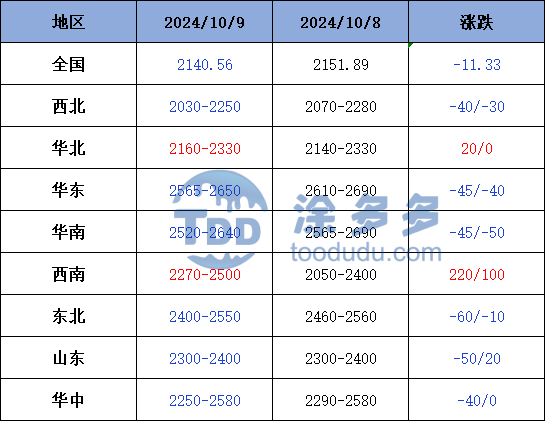

Methanol: Futures market fluctuated and fell back. China's market trends were mixed

On Oct. 9, the methanol market price index was 2140.56, down 11.33% from yesterday and 0.53% lower than yesterday.

Outer disk dynamics:

Methanol closed on October 8:

China CFR ranges from US $308 to US $317 per ton, up US $8 per ton

Us FOB 109-110cents per gallon, flat

CFR in Southeast Asia: us $345-346 per ton, Ping

European FOB 361.5-362.5 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2230-2250 (0), North: 2030-2100 (- 75), South: 2070 (- 30), Lunan: 2380-2400 (0), Henan: 2250-2330 (- 40), Shanxi: 2160-2250 (0), Port: 2565-2585 (- 45)

Freight:

North Route-North Shandong 160-220 (0ram 0), North Route-South Shandong 230-260 (- 20 Maxime 30), South Line-North Shandong 220-250 (- 10 mer 0), Guanzhong-Southwest Shandong 160-220 (- 50 Compay 40)

Spot market: today, the price trend of methanol market is different, the futures market is high, and China's spot market is up and down each other. Although there is a certain replenishment demand downstream, due to the large increase in spot market prices yesterday, some terminal operators hold certain resistance to the current high prices, some auction companies in the main production areas have failed to auction, and the local market gives up yesterday's gains. Specifically, the market prices in the main producing areas fluctuated, with the quotation on the south line around 2070 yuan / ton, 30 yuan / ton lower than yesterday, and the price on the north line around 2030-3100 yuan / ton, down 75 yuan / ton at the low end, the high level of the futures market fell back, the trading atmosphere in the market cooled slightly, and some bidding enterprises failed to auction. The market price fluctuation in Shandong, the main consumer area, is limited, with 2380-2400 yuan / ton in southern Shandong and 2320-2340 yuan / ton in northern Shandong. The mood of restocking downstream after the holiday is not good, and it is inconsistent with the current high prices. The trend of market quotations in North China varies. Hebei quotes 2300-2330 yuan / ton today, while the lower end increases 160yuan / ton. Downstream factory purchases are still dominated by rigid demand, with limited support for the market. Shanxi quotes 2160-2250 yuan / ton today, the low end is stable, the futures market fluctuates down, the market trading atmosphere cools, and the purchasing mood of users is poor, and some methanol enterprises operate in order to keep the goods out of stock.

Port market:Methanol futures fluctuated today and fell in late trading. Monthly contract rigid demand negotiations, positive offer; long-term part of unilateral shipments, arbitrage and exchange mainly, the basis is stable. In late trading, the shipping atmosphere continued and the basis weakened. The overall deal is OK. Taicang main port transaction price: 10 transaction price: 2565-2585, base difference 01 "30 prime price 37 position 10 deal: 2570-2580, base difference 01" 40 pm 42 position 10 deal: 2565-2595, base difference 01 "40 shock 45 option 11 transaction: 2585-2595, base difference 01: 50.

Future forecast:The macro positive boost has weakened, the high futures price of the main contract of methanol has fallen, the spot market price of the port has fallen with the market, and some regional markets in China have given up yesterday's gains under the influence of poor demand for post-holiday replenishment in the lower reaches, and due to the large increase in spot prices yesterday, some downstream hold certain resistance to the current high prices, and the market transaction atmosphere has cooled slightly. At present, the follow-up of the demand in the downstream market is not as expected, and the futures market is high, and the operators hold a certain resistance to the future, and it is expected that the price of methanol in the spot market will be adjusted within a narrow range in the short term, but in the later stage, we need to pay close attention to the prices of crude oil and coal, the operation of the plant in the field and the follow-up of downstream demand.