Gasoline: China's gasoline market rebounded during the National Day holiday. Where will the market outlook go?

Gasoline: China's gasoline market has stopped falling and rebounded during the National Day holiday. What will happen in the future?

Foreword:Enter the fourth quarter, during the National Day holiday, supported by the cost of crude oil, stop falling and rise, how will the recovery working day go after the holiday.

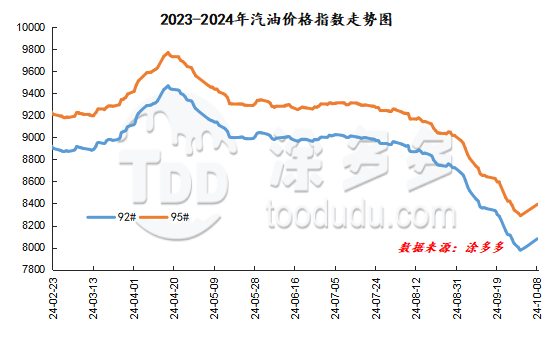

As of Sept. 30, China's gasoline price index had fallen more than 1450 from its April peak. Specifically, the 9-month gasoline price index fell 1485.56, or 15.70%, from April 17, down 1477.14, or 15.12%, from April 17. At the beginning of the third quarter, gasoline prices fell significantly, especially in September. During the October National Day holiday, the market as a whole rebounded. As of October 8thChina's gasoline price index was 8081.13, up 102.39, or 1.28%, from September 30, while China's gasoline price index was 8392.91, up 103.38, or 1.25%, from September 30.Next, let's learn about the recent situation of China's gasoline market in terms of supply and demand.

In terms of crude oil:In terms of international crude oil, it has been up for several days since October 1. As of October 8, WTI rose 13.16% and Brent rose 12.86%. International crude oil prices continued to decline in September, especially on September 10, with WTI down 4.31% and Brent down 3.69%.It hit a new low since May last year. In the future, the OPEC+ production reduction will be implemented at least until the end of November.Russia does not rule out the extension of the OPEC+ agreement to 2025, coupled with the potential supply risks caused by the geographical situation still exist, international oil prices may remain high in the short term.

Supply sideRecently, China's supply tends to be ample. Judging from the start-up situation in China, the operation rate of the main refinery in September was 77.55%, an increase of 0.10% from the previous month; the operation rate of independent refineries was 58.97%, an increase of 3.16% from the previous month. Compared with before August, the start-up of the main independent refinery all increased again. Interspersed with the National Day holiday in October, the number of new maintenance refineries continued to increase, coupled with the peak demand season in China, the supply side continued to rise in line with the demand trend, the main business is expected to fluctuate slightly independently, and the market has rebounded in the near future, and production does not rule out the possibility of adjustment in the later period.

Demand sideRefinery inventory reduction and sales promotion increased in the last week before the holiday. The stock before the Mid-Autumn Festival and the replenishment after the festival are not as expected, and the large number of trips during the National Day holiday brings favorable support to the demand. The cost end of superimposed crude oil rises continuously for many days, the overall market demand is OK, and the trading atmosphere is hot. However, the terminal demand for gasoline may decline after the festival, which is mainly manifested in the return to daily life of private cars, the reduction of travel frequency and the reduction of fuel consumption of air conditioners for cooling cars, and the increase of negative factors in the market. The bearish mentality of the middle and lower reaches is gradually rising, and then the demand side may return to weak operation. The enthusiasm of traders to receive goods may have diminished, and the pressure on refineries to ship goods has gradually increased. From the perspective of the future, the boost from the demand side of the National Day in early October, coupled with the positive pull of international crude oil, may extend short-term support, but it may be difficult to support the upward trend of oil prices under the weak situation of the overall market demand side, and there may be a pullback in mid-October. When the weather turns cooler in November, the frequency of private car travel may increase, and the consumption of gasoline is better than that in October. However, the probability of haze weather in northern China increases in winter, and the probability of environmental control also increases or suppresses private car travel.

To sum up, the oil market may be better in October than in September, but it needs to be followed up.