Methanol: Macroeconomic benefits support the current wide increase in methanol period

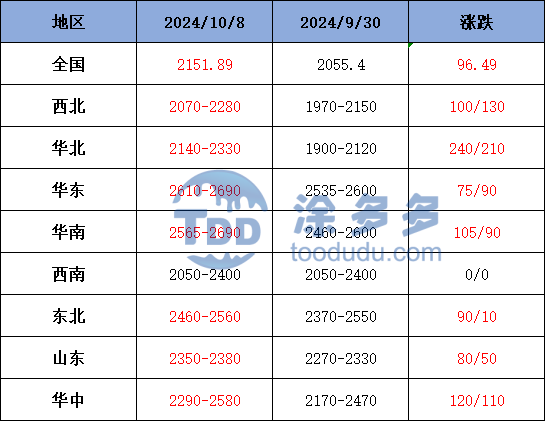

On October 8th, the methanol market price index was 2151.89, up 96.49 from the previous working day and 4.69% higher than the previous working day.

Outer disk dynamics:

Methanol closed on October 7:

China is closed.

Us FOB 109-110cents per gallon, flat

CFR in Southeast Asia: us $345-346 per ton, Ping

European FOB 361.5-362.5 euros / ton, up 1 euro / ton.

Summary of today's prices:

Guanzhong: 2230-2280, Northern Route: 2105-2130, Southern Route: 2100, Lunan: 2380-2400, Henan: 2290-2340, Shanxi: 2160-2280,260, Port: 26102630 (75)

Freight:

North Route-North Shandong 160-220 (- 50 Uniqure 50), Northern Route-Southern Shandong 250-290 (- 10 Uniqure 20), Southern Route-Northern Shandong 230-250 (- 20 Maple 50), Guanzhong-Southwest Shandong 210-260 (0max 0)

Spot marketToday, the methanol period is rising synchronously, and the international crude oil price is significantly higher under the influence of geopolitical tensions, which in turn leads to the collective adjustment of the chemical sector, the wide upward movement of methanol futures, and the improvement of the mentality of the operators in the market. although the inventory of some Chinese manufacturers has increased in the festival, but there is a certain rigid demand in the lower reaches after the festival, and under the support of good macro-economy, on the first day after the festival, the center of gravity of methanol period has moved up. Specifically, the market prices in the main producing areas have been raised, with the quotation for the southern route around 2100 yuan / ton, the northern line around 2105-2130 yuan / ton, the low end up to 105 yuan / ton, Rongxin methanol bidding for 6, 000 tons, and finally 2105 yuan / ton for all transactions; Yulin Yanzhou Mining bid for 6, 000 tons, with a final turnover of 2070-2075 yuan / ton; Shaanxi Weihua bid for 2, 000 tons, with a final turnover of 2270 yuan / ton. Driven by the macro positive, methanol futures market trend is strong, the methanol spot market is obviously boosted, some manufacturers in the region quote homeopathic push up, some downstream there is a certain replenishment demand, the overall market transaction is OK. Market prices in Shandong, the main consumer area, have risen sharply, with 2380-2400 yuan / ton in southern Shandong and 2320-2340 yuan / ton in northern Shandong, with an increase of 50 yuan / ton at the low end, a wide upward move in the futures market, an improvement in the mentality of market operators, and a wave of stock preparation operations downstream after the festival. the market trading atmosphere is OK. With the high market quotation in North China, Hebei quotation is 2140-2330 yuan / ton today, and the low end is raised by 50 yuan / ton. after the festival, methanol market prices in the surrounding areas have risen one after another, supporting the mentality of methanol manufacturers in Hebei; Shanxi quotes 2160-2280 yuan / ton today, an increase of 260 yuan / ton compared with the pre-festival, mainly boosted by the macro-level, the enthusiasm of operators to enter the market to replenish stocks, and the bidding premium of methanol enterprises is larger.

Port market:High consolidation of methanol futures today. Monthly contract negotiations; long-term unilateral shipments are limited, arbitrage buying is the main, and the basis is slightly stable. The overall transaction throughout the day is mediocre. Taicang main port transaction price: 10 transaction price: 2610-2630, basis difference 01: 37 prime price 40 position 10 transaction price: 2600-2630, base difference 01: 40 transaction 10 transaction price: 2600-2650, basis difference 01: 43 prime transaction 45 transaction 11 transaction: 2600-2650, basis difference 01: 50.

Future forecast:The strong rise in international crude oil prices has led to a collective increase in the chemical sector, and the wide range of methanol contract prices has given a significant boost to the spot market prices. although the inventories of some manufacturers in the main producing areas have increased during the National Day holiday, they have returned after the festival. there is a certain replenishment demand in some downstream markets, and driven by macro benefits, the operators in the market have certain positive expectations for the future. At present, it is expected that the short-term methanol market price is on the strong side, but the extent of continued increase may be relatively limited. In the later stage, we need to pay close attention to the crude oil and coal prices, the operation of the plant in the field and the wide upward movement of the spot price.