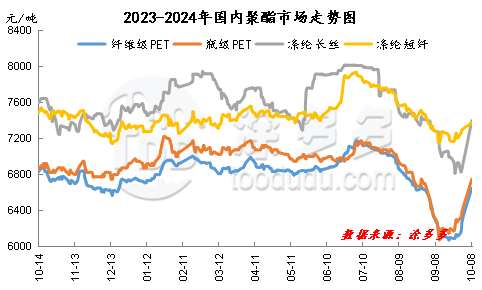

Polyester: Macroeconomic benefits stimulate the polyester chain to open higher across the board after the holiday

During the National Day holiday, the situation in the Middle East continued to deteriorate, international oil prices rose for the fifth trading day in a row, European and American crude oil futures rose by more than 12% compared with the pre-holiday period, and Brent crude oil futures once again exceeded 80 US dollars per barrel. China's macro-stimulus, driven by capital sentiment, China's commodity market strengthened collectively after the holiday. After returning from the National Day holiday, Chinese crude oil futures rose by the daily limit in early trading, and the chemical sector rose across the board, with polyester chain leading the way, with PX futures up 3.95%, ethylene glycol futures up 3.61%, polyester staple fiber futures up 2.69%, and polyester bottle chip futures up 2.49%.

China's stock market and futures began to rise sharply after a series of fiscal stimulus measures were launched before the National Day holiday, which revived investor confidence. Driven by this, the polyester industry chain market began to rebound before the festival. During the holiday period, driven by the rise in crude oil, polyester upstream PX prices continued to rebound, Asian PX market closing price rose 30 US dollars / ton to 928 US dollars / ton CFR China, cost support strengthened.

From the point of view of the supply and demand of PTA itself, the equipment of PTA enterprises has changed frequently recently, and the start-up of PTA enterprises has risen to the level of around 83%. The spot supply in the market is sufficient, and PTA is in a stock accumulation cycle. The 1.2 million-ton installation in Sanfang Lane was temporarily stopped on September 25th and restarted during the holiday period. The negative operation of a 3.6 million-ton PTA plant in Yisheng Petrochemical Company was reduced during the holiday and resumed on the 7th. The 1.2 million-ton PTA plant in Zhongtai, Xinjiang was shut down on October 6th, and the restart time has yet to be determined. From the demand side, the recent start-up of downstream polyester enterprises has rebounded to around 91%. With the support of the peak season of the terminal textile and weaving industry, the weaving operating rate has increased slightly, and the local volume of grey cloth has increased. The demand side forms support to the market.

From the point of view of the supply and demand of ethylene glycol itself, with the recovery of several sets of maintenance equipment recently, the start-up of the industry as a whole has gradually rebounded to more than 60%, coupled with the planned start-up of new production capacity, the market supply will gradually increase. The 200000-ton ethylene glycol plant in Puyang, Henan Province was shut down on October 19, 2023 due to efficiency problems, and was restarted during the National Day period. The 200000-ton ethylene glycol plant in North China was shut down and overhauled on July 10th and restarted in early October. The 450000-ton ethylene glycol plant of far East Union is scheduled to be shut down and overhauled on October 9th and is expected to restart in early November. A 400000 t / an ethylene glycol plant from syngas in Xinjiang was restarted in early October. Xinjiang Tianye 600000 ton ethylene glycol plant was shut down and overhauled for about one month at the end of September. A 300000-ton ethylene glycol plant in Inner Mongolia was stopped for maintenance near September 20 and is expected to last 20-25 days. East China main port ethylene glycol port inventory reduction, supply-side support to the market in general; demand: downstream polyester load rebounded to more than 90%, coupled with the terminal textile market peak season support, rigid demand to support the market.

The Information Office of the State Council held a press conference on October 8. In view of the new situation and problems in the current economic operation, China has stepped up efforts to launch a package of incremental policies to promote the sustained recovery of the economy. Under the superposition of a series of positive policies, the macro mood outside China has improved, the enthusiasm of the market bulls has rebounded, and the impact of the weak reality of the polyester market on the market has temporarily weakened. Short-term polyester market may maintain a strong shock trend, continue to pay attention to the international crude oil and market supply and demand to promote the market.