Methanol: The market fluctuated in the afternoon and the spot market fell sharply

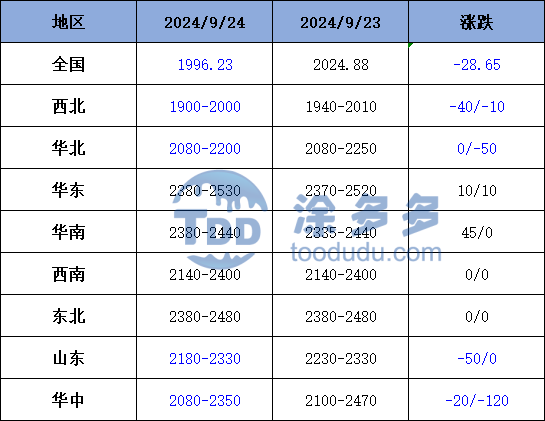

On September 24th, the methanol market price index was 1996.23, down 28.65 from yesterday and 1.41 per cent from the previous month.

Outer disk dynamics:

Methanol closed on September 23:

China CFR 283-287 US dollars / ton, down 5 US dollars / ton

Us FOB 105-106 cents per gallon, down 1 cent per gallon

Southeast Asia CFR US $344-345 per ton, Ping

European FOB 340.5-341.5 euros / ton, down 6 euros / ton.

Summary of today's prices:

Guanzhong: 1890-1980 (- 40), North: 1900 (- 60), South: 2000 (0), Lunan: 2145 (- 35), Henan: 2080-2100 (- 20), Shanxi: 2080-2220 (0), Port: 2380-2410 (5)

Freight:

North Route-North Shandong 205-260 (- 5gammer Mel 10), North Line-South Shandong 260-310 (0amp 0), South Line-North Shandong 240-260 (10max 0), Guanzhong-Southwest Shandong 180-240 (0amp Mueller 10)

Spot marketToday, the methanol market price continues to be weak, the pessimism of the operators in the market is obvious, the enthusiasm of the downstream operators to enter the market to replenish the stock is not high, the quotations of some manufacturers in the main producing areas have been lowered under the influence of increased inventory pressure, and the overall trading atmosphere of the market is limited; the futures market rebounded at a low level under the stimulus of the macro-positive policy, and the quotation of the port spot market was adjusted along with the market. Specifically, market prices in the main producing areas have fallen within a narrow range, with quotations on the southern line around 2000 yuan / ton, the northern line around 1900 yuan / ton, and the low end down by 60 yuan / ton. The prices of some bidding enterprises continue to fall, and individual manufacturers can make deals, but there is still a phenomenon of failing auction in some areas, and low-level replenishment by downstream and traders has slightly increased. The market prices in Shandong, the main consumer area, are adjusted in a narrow range, with southern Shandong 2180-2200 yuan / ton and northern Shandong 2200-2220 yuan / ton, with a stable low end. under the influence of buying up and not buying or falling in the downstream, the mood of replenishment in the market is limited, and the trading atmosphere on the market weakens. The market quotation in North China has been lowered along with it. Hebei quotation is 2130-2200 yuan / ton today, and the low-end price is 70 yuan / ton. the market wait-and-see atmosphere is rich, and the negotiation atmosphere is poor; Shanxi quotation is 2080-2220 yuan / ton. at present, methanol futures market has stopped falling and rebounded, which has boosted the mentality of operators, but the recovery of terminal downstream market demand is limited, and manufacturers' shipments are general under rigid demand.

Port market:Today, methanol futures fluctuated higher. The spot transaction is limited. On-demand purchases in the morning months, appropriate price follow-up, long-term arbitrage and swap; afternoon futures rebound, some higher shipments, the basis is weaker. The replacement of goods has continued in recent months. The overall deal is OK. Taicang main port transaction price: spot transaction: 2380-2410, base difference 01: 35: 9, basis: 2385-2430, base difference: 01: 35, margin: 42: 10: 2400-2435, basis: 01: 43: 48: 10: 2410-2445, basis: 01: 55: 60.

Future forecast:Stimulated by the macro-positive policy, the low price of the main contract of methanol rebounded, which slightly boosted the market sentiment, but in view of the limited recovery of demand in the downstream market, some operators still hold a wait-and-see mood towards the future, although it is approaching the National Day holiday. however, the demand of downstream operators to enter the market for stock is limited, and some manufacturers in the main producing areas have a certain inventory demand, and it is expected that the Chinese market may continue to be weak in the short term, but we need to pay attention to coal prices in the later stage. Follow up the operation of the plant in the field and the downstream demand.