PVC: Futures struggled without success and returned to low levels, calcium carbide soared, and spot prices were weak and real orders gave profits

PVC Futures Analysis:September 23 V2501 contract opening price: 5222, highest price: 5252, lowest price: 5180, position: 1027948, settlement price: 5218, yesterday settlement: 5246, down 28, daily trading volume: 1047321 lots, precipitated capital: 3.734 billion, capital outflow: 23.97 million.

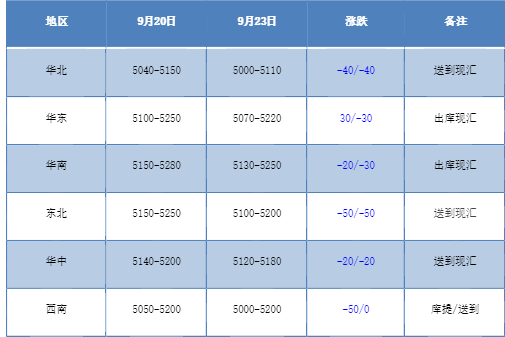

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of China's PVC market remains weak, and the spot market does not work well. Compared with the valuation, it fell by 40 yuan / ton in North China, 30 yuan / ton in East China, 20-30 yuan / ton in South China, 50 yuan / ton in Northeast China, 20 yuan / ton in Central China and 50 yuan / ton in Southwest China. Upstream PVC production enterprises have not seen obvious adjustment action, most wait-and-see stable price shipments, but have not heard of large orders, still sign orders with basic quantity. The futures market is arranged at a low level, the spot market price and the spot market price coexist, and the basis offer is adjusted slightly, including the East China base offer 01 contract-(70-150), the South China 01 contract-(0-50 or + 30), the North 01 contract-(230-350), and the southwestern supply heard of 01 contract-(500). Although the two quotation methods, but the spot market transactions are weak, traders offer a single part of a small negotiation, the basis offer price is not obvious advantage, downstream procurement enthusiasm is not high, spot transaction is not good.

From the perspective of futures:The night price of PVC2501 contract opened slightly volatile, but then fell in intraday trading. After the start of morning trading, the price bottomed out and rebounded to a certain extent, but the high point was limited, and then in the process of shock, it returned to its low in the late afternoon. 2501 contracts fluctuated in the range of 5180-5252 throughout the day, with a spread of 72. 01 contracts with an increase of 1323 positions, with 1027948 positions so far, 2505 contracts closing at 5436 and 150693 positions.

PVC Future Forecast:

In terms of futures:After the operating night trading of the PVC2501 contract price reached a low, it also showed a certain rise in the short period of trading on Monday, but struggled fruitlessly to return to the low range in the afternoon. The technical level shows that the opening of the three tracks of the Bolin belt (13, 13, 2) is downward, the KD line of the daily line begins to show the trend of dead fork, and the trend of dead fork of MACD line expands, which is not clear in terms of transaction. From the perspective of the operating trend of futures prices, in the low market period, there is a certain short-term sentiment, but in the absence of clear support, more consideration should be given to intra-day short-term operations. Therefore, the market performance is unstable, and in the short term, we think that the operation of futures prices may still test the performance of the low range of 5150-5250.

Spot aspect:At the beginning of the week, merchants in the spot market began to offer a certain amount of profit compared with last Friday. In order to promote the speed of supply digestion, we negotiated alone. Although entering this week is approaching the National Day, the spot market has never heard of the emergence of the intention to hoard goods, and the expectation of gold, silver and silver has been strangled. PVC fundamentals, the cost of port calcium carbide prices rose sharply, up 50-75 yuan / ton today, VCM single, Taixing Xinpu VCM lowered 50 today factory 4850-4950 acceptance week pricing, PVC plant start-up load slightly increased, supply increased slightly, but the demand side is still lukewarm, except the rigid demand part does not have more demand. The fundamentals of PVC under the game of supply and demand are still weak. In the outer disk, prices in the international crude oil futures market fell slightly as lingering fears of a slowdown in global oil demand triggered by the global economic slowdown outweighed the impact of geopolitical tensions in the Middle East. On the whole, PVC spot prices continue to hover at low levels in the short term.