Methanol: Futures market fluctuated at a low level and the spot market adjusted within a narrow range

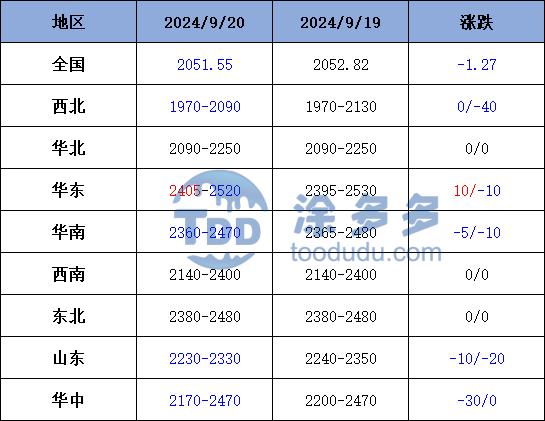

On September 20, the methanol market price index was 2051.55, down 1.27 from yesterday and 0.06 per cent lower than yesterday.

Outer disk dynamics:

Methanol closed on September 19th:

China CFR 288-292 US dollars / ton, up 2 US dollars / ton

Us FOB 108-109 cents per gallon, up 1 cent per gallon

Southeast Asia CFR US $344-345 per ton, Ping

European FOB 349.5-350.5 euros / ton, down 0.5 euros / ton.

Summary of today's prices:

Guanzhong: 2030-2090 (- 30), North: 1970-2000 (0), South: 2020 (0), Lunan: 2235-2250 (0), Henan: 2170-2200 (- 30), Shanxi: 2090-2220 (0), Port: 24052420 (10)

Freight:

North Line-200-250 North Shandong (0ax 0), North Line-South Shandong 280-300 (0ax 0), South Line-North Shandong 220-270 (0ax 0), Guanzhong-Southwest Shandong 160-210 (0max 0)

Spot marketToday, the methanol market price is adjusted in a narrow range, the market quotation in some areas has dropped, and the downstream market demand recovers slowly. under the rigid demand, the market transaction atmosphere is general. Specifically, the market prices in the main producing areas are adjusted narrowly. The quotation on the southern route revolves around 2020 yuan / ton, which is 30 yuan / ton lower than that of yesterday. The quotation of the northern line revolves around 1970-2000 yuan / ton, and the lower end is reduced by 40 yuan / ton. The performance of the futures market is weak, and the enthusiasm of downstream and traders to enter the market is not high. The market price in Shandong, the main consumer area, is adjusted in a narrow range, with 2235-2250 yuan / ton in southern Shandong and 2230-2250 yuan / ton in northern Shandong. The low end is stable, traders and downstream maintain rigid demand to purchase goods cautiously, and the market transaction atmosphere is general. The fluctuation of market quotation in North China is limited. Hebei quotation is 2200-2250 yuan / ton today, and the lower end is reduced by 40 yuan / ton. the market wait-and-see atmosphere is rich, and the negotiation atmosphere is poor; Shanxi quotes 2090-2220 yuan / ton today. Downstream users and traders have a weak mentality to enter the market, buying and buying is mainly based on rigid demand, and it is difficult to sell volume in the market.

Port market:Today, the futures range fluctuates. In recent months, rigid demand replenishment, long-term arbitrage buying price follow-up, selling cautious shipment. The current basis is strong, and the idea of replacement continues in recent months. The overall transaction is active. Taicang main port transaction price: spot / 9: 2395-2420, base difference 01 "20 picks 30" 9 deal: 2400-2425, base spread 01 "35" 10 transaction prices: 2425-2445, base difference 01 "55 prime 60"

Future forecast:Next week is the last week of the National Day short holiday, and there may be a certain replenishment demand in the downstream market. With the release of demand, manufacturers in the main producing areas may have a certain up-price sentiment, and the market price of methanol in China may have been raised somewhat, but considering that the manufacturers also have a certain inventory demand, under mutual hedging, the increase in market prices may be relatively limited. In the port market, recently, due to the influence of typhoon weather, the arrival and unloading of imported cargo in Hong Kong has decreased compared with the previous period, and the port inventory is in a state of de-storage. there may be a small amount of replenishment demand downstream before the National Day next week, and it is expected that methanol port inventory will still be slightly removed in the short term. At present, it is expected that the methanol market price will be adjusted in a narrow range next week, and there is little possibility of an overall increase, but in the later stage, we need to pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.