PVC: The high point of the futures price is approaching the middle track, but the high point cannot be sustained, and the spot price is divided

PVC Futures Analysis:September 13th V2501 contract opening price: 5385, highest price: 5423, lowest price: 5323, position: 991629, settlement price: 5378, yesterday settlement: 5375, up 3, daily trading volume: 1178779 lots, precipitated capital: 3.697 billion, capital inflow: 11.4 million.

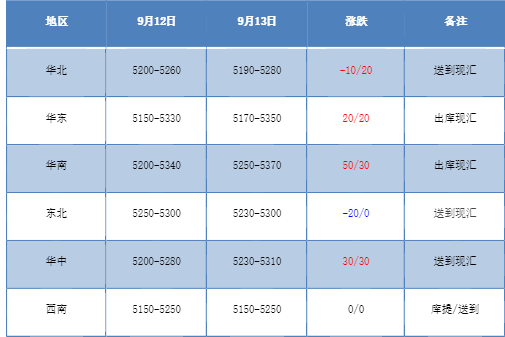

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price in China's PVC market is still relatively chaotic, with prices rising slightly in the morning. Compared with the valuation, the low end of North China fell 10 yuan / ton, the high end rose 20 yuan / ton, East China rose 20 yuan / ton, South China rose 30-50 yuan / ton, the low end of Northeast China fell 20 yuan / ton, and Central China rose 30 yuan / ton. the southwest region is stable. Most of the upstream PVC production enterprises hold the wait-and-see quotation, and there is no obvious adjustment trend, but there are not many contracts signed in the first generation, and the enterprise inventory is digested and maintained in the early stage. Futures night trading and slightly stronger operation in the morning, so the spot market price rose slightly in the morning, but the transaction was not good, the afternoon price fell to a low, the price advantage was relatively obvious, and the basis adjusted slightly. Among them, the base difference offer 01 contract in East China-(100-180-230), South China 01 contract-(0-160), North 01 contract-(240-270-330) Some low-cost sources in southwest China have heard of 01 contract-(510). The rise and fall of prices did not lead to an improvement in transactions in the spot market, but continued to focus on rigid demand procurement, the recent lack of overall feedback in the market is slightly depressed.

From the perspective of futures:The night price of the PVC2501 contract opened slightly higher, with the futures price reaching a peak of 5423, and the market once ran well. After the start of morning trading, the futures price was sorted out in a relatively high and narrow range, followed by a slight decline, and further weakened and returned to the low in the afternoon. 2501 contracts fluctuate from 5323 to 5423 throughout the day, with a spread of 100,01and an increase of 19001 positions, with 991629 positions so far, 2505 contracts closing at 5582 and 136140 positions.

PVC Future Forecast:

In terms of futures:The operation of the PVC2501 contract price shows a certain upward performance, the high point is close to the middle rail position of the Bollinger belt, but the high price is not sustainable, that is, it is suppressed downwards. in terms of transaction, the short opening is 25.2% higher than that of 23.6% more. judging from the current market trend, when the futures price reaches a certain high point, there will be a new short order to enter the suppression trend. Therefore, before the overall environment is weak or there is no clear uplink signal, the disk tends to consider interval shocks. The technical level shows that the Bollinger belt (13, 13, 2) three tracks narrowed, the price continues to run sideways, in the short term we still maintain the previous point of view, observe the performance of the range 5250-5500.

Spot aspect:The strength of the futures market in the night and in the morning still supported the increase in the spot market in the morning, with prices in various regions rising slightly, but basically giving up the increase in the afternoon. We also mentioned in the previous forecast that the rise and fall of prices did not stimulate spot transactions sufficiently, and the downstream always maintained the mentality of rigid demand to take goods. Even near the Mid-Autumn Festival short holiday, the spot market has not heard of the volume of transactions, and traders have maintained transactions. Upstream production enterprises inventory digestion has not been accelerated. At the level of supply and demand, it is difficult to support the reversal of prices in the two markets, the price of calcium carbide at the cost end has been rising, the calcium carbide method has a certain support, but can not shake the overall weak market, the production pressure of calcium carbide enterprises increases. At present, the overall commodity index is also low and fluctuating slightly, which comes from the lack of policy guidance in the short term, and the PVC spot market continues the trend of low and narrow consolidation.