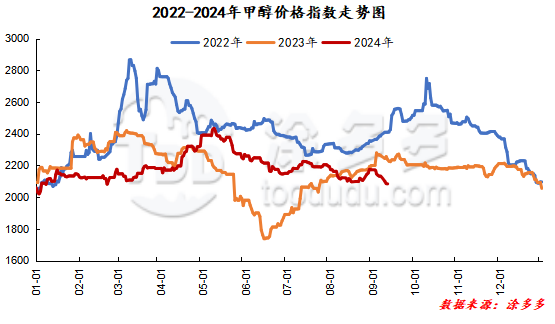

Methanol: Futures range fluctuates and the spot market continues to operate in a weak position

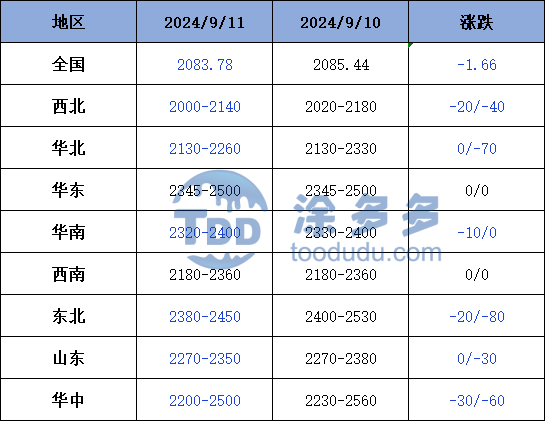

On Sept. 11, the methanol market price index was 2083.78, down 1.65% from yesterday and 0.08% lower than yesterday.

Outer disk dynamics:

Methanol closed on September 10:

China CFR 276-280USD / ton, down US $2 / tonne

Us FOB 106107cents / gallon, flat

Southeast Asia CFR US $344-345 per ton, Ping

European FOB 336-337 euros / ton, down 1 euro / ton.

Summary of today's prices:

Guanzhong: 2100-2140 (- 20), North: 2020-2030 (0), South: 2050 (0), Lunan: 2280 (0), Henan: 2200-2230 (- 30), Shanxi: 2130-2220 (0), Port: 23452370 (0)

Freight:

North Route-200-240 Northern Shandong (0Universe Mur20), Northern Route-Southern Shandong 280-300 (- 30 Uniqure 35), Southern Route-Northern Shandong 200-260 (- 20 amp 0), Guanzhong-Southwest Shandong 150-190 (- 10 Universe 40)

Spot marketToday, the methanol market price continues to run weakly, the futures market interval fluctuates, and the mindset of the market operators is empty. although the Mid-Autumn Festival holidays are interspersed in the week, the enthusiasm of downstream operators to enter the market and replenish goods is relatively limited, and the shipments of manufacturers in the main producing areas are general. Some manufacturers in order to reduce inventory pressure to save profits and other operations, but the market transaction has not significantly improved. Specifically, the market price in the main producing areas is adjusted narrowly, and the quotation on the south line revolves around 2050 yuan / ton, maintaining yesterday, the price on the north line revolves around 2020-2030 yuan / ton, the low end is stable, the futures market is volatile, and the mindset of the operators in the market is poor. The enthusiasm of most operators in the market to enter the market is limited, and some manufacturers make profit operations in order to reduce inventory pressure, but the restocking operators only maintain rigid demand, and the market transaction atmosphere is general. Market prices in Shandong, the main consumer area, fell narrowly, with 2280 yuan / ton in southern Shandong and 2270-2300 yuan / ton in northern Shandong, with low-end stability, weak downstream demand to maintain rigid demand for goods, limited willingness of traders to hold goods, and lower transfer prices. The market quotation in North China has been lowered along with it. Hebei quotation is 2240-2260 yuan / ton today, and the low-end price is reduced by 50 yuan / ton. most operators are more bearish about the future, and the market talks about keeping down the price operation; Shanxi quotes 2130-2220 yuan / ton today. at present, most of the downstream manufacturers' raw material inventory maintains a medium-high level, the market inquiry atmosphere is poor, and the transaction volume is limited.

Port marketMethanol futures rebounded after falling today. In recent months, replenishment according to demand, affordable transaction; long-term arbitrage operation is mainly, some unilateral higher than low, with futures fluctuations to choose the opportunity to close the transaction. The base difference is slightly weaker, and the goods are exchanged frequently in recent months. The overall deal is OK. Taicang main port transaction price: spot transaction: 2345-2370, base difference 01: 5: 9 transaction: 2350-2380, base difference 01: 7, transaction price: 2350-2385, basis difference: 01: 15 prime 17: 10 transaction: 2365-2405, basis difference 01: 35: 40.

Future forecast:Recently, the international crude oil price has dropped obviously, and the low level shock of methanol futures market is beneficial to the mindset of operators in the short market to a certain extent. although the Mid-Autumn Festival holiday is interspersed in the week, the recovery of traditional downstream demand is relatively slow, and the futures market is low and fluctuating. the pessimism of traders in the market is obvious, the enthusiasm of traders and terminal downmarket operators to enter the market is limited, and some manufacturers operate in order to reduce inventory pressure. At present, some operators in the market are strongly bearish about the future, and it is expected that the methanol market price will fluctuate in the short term, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.