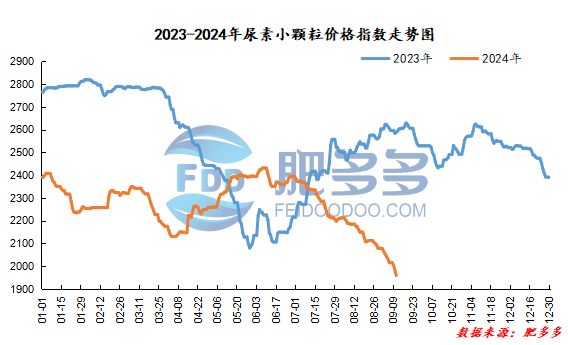

Daily Review of Urea: Weak market prices continue to hit new lows for the year (September 11)

China Urea Price Index:

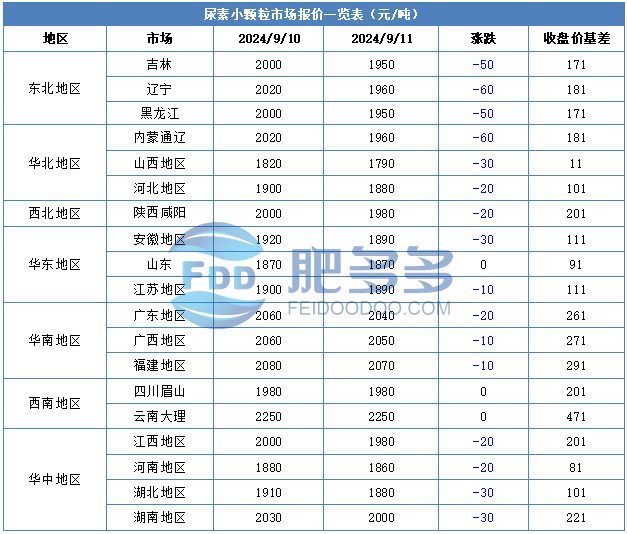

According to Feiduo data, the urea small pellet price index on September 11 was 1,958.77, a decrease of 25.14 from yesterday, a month-on-month decrease of 1.27% and a year-on-year decrease of 24.34%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1739, the highest price is 1785, the lowest price is 1729, the settlement price is 1757, and the closing price is 1779. The closing price is 14 compared with the settlement price of the previous trading day, up 0.79% month-on-month. The fluctuation range of the whole day is 1729-1785; the basis of the 01 contract in Shandong is 91; the 01 contract has increased its position by 8486 lots today, and so far, it has held 195965 lots.

Today, urea futures prices mainly opened lower and moved higher with the market environment. Mainly because the market has certain policy expectations for this week's important meeting in China, and the US inflation data will be released tonight or further interest rate cuts will be traded, the overall commodity market has warmed up due to the macro market atmosphere. However, the fundamentals of urea itself have not improved significantly. The large accumulation of stocks during the week basically confirms the price decline in the previous period. The cautious attitude of downstream procurement and the downward price feedback each other. The short-term urea market may still operate around its own weak fundamentals, but the macro atmosphere is disturbed or temporarily amplify price elasticity.

Spot market analysis:

Today, China's urea market price fell to a new low level again, and a moderate amount of new orders at low prices were sold in the market.marketIt is still operating in a weak position, and prices continue to fall.

Specifically, prices in Northeast China have been lowered to 1,950 - 1,970 yuan/ton. Prices in East China have been lowered to 1,850 - 1,900 yuan/ton. The price of small and medium-sized particles in Central China has been lowered to 1,860 - 2,080 yuan/ton, and the price of large particles has been lowered to 1,910 - 2,060 yuan/ton. Prices in North China have been lowered to 1,790 - 1,970 yuan/ton. Prices in South China have been lowered to 2030-2080 yuan/ton. Prices in northwest China have been lowered to 1,930 - 1,980 yuan/ton. Prices in Southwest China are stable at 1,980 - 2,300 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers 'quotations continue to fall, but the overall order acquisition situation is relatively general. Under the pressure of shipments, price reductions are endless, which makes the focus of market negotiations on new orders continue to decline. High-end quotations of enterprises are gradually moving closer to low-end levels, and overall order acquisition situation is not good. In terms of the market, the market situation is temporarily stable and unchanged from the previous period. The transaction of new orders is weak. There is no other effective positive support for the market. Although prices continue to fall, the low-price transactions on the market are also relatively general. The market is stable. It is difficult to maintain stability, and the mood of operators has dropped significantly. On the supply side, the supply side continues to be loose, and the industry continues to have sufficient supply. The current industry's capacity utilization rate continues to remain above 80%, which affects the market. On the demand side, the progress of fertilizer use in autumn is slow, and demand follow-up is not smooth. The mentality of the industry is still cautious, and most of them purchase sporadic small orders. Large-scale purchases still need to wait for the improvement of the autumn fertilizer replenishment market.

On the whole, the current market situation lacks good news to boost it, and the market is weak. It is expected that the urea market price will continue to maintain a weak consolidation operation in the short term.