PVC: The low futures price has refreshed the previous low, the gold nine and silver ten have been killed, and the real spot order has slightly yielded profits

PVC Futures Analysis:V2501 contract opening price: 5340, highest price: 5398, lowest price: 5282, position: 1024964, settlement price: 5341, yesterday settlement: 5336, up 5, daily trading volume: 1343274 lots, precipitated capital: 3.844 billion, capital outflow: 70.94 million.

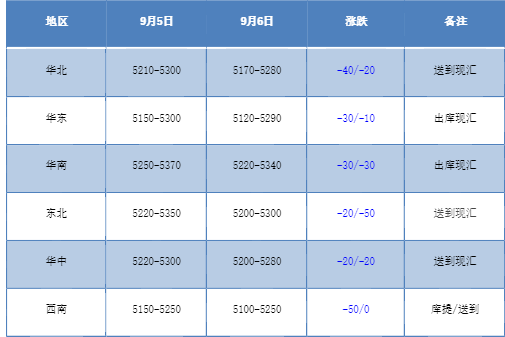

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of China's PVC market remains weak, and the spot market has heard of a small profit. Compared with the valuation, it fell by 20-40 yuan / ton in North China, 10-30 yuan / ton in East China, 30 yuan / ton in South China, 20-50 yuan / ton in Northeast China, 20 yuan / ton in Central China and 50 yuan / ton in Southwest China. The ex-factory price of upstream PVC production enterprises mainly remained stable, and some enterprises reduced by 50 yuan / ton, including ethylene enterprises. The daily futures price continued to decline, the spot market trader offered a steady drop in price, the actual transaction and the signing of orders offered a profit range of 10-20 yuan / ton, the basis offer was slightly adjusted, and the base difference narrowed. Among them, East China basis offer 01 contract-(50-100-150-200), South China 01 contract-(0-80 or + 20), North 01 contract-(230-320) Some low-cost sources in southwest China have heard of 01 contract-(520). On the whole, it is difficult to close a deal at a high price in the spot market, and it is mainly discussed on a single basis. the point-price supply has a price advantage, and the spot transaction is mediocre.

From the perspective of futures:The night price of PVC2501 contract opened slightly higher, and the price showed some upside repair. But prices began to fall again in early trading, even falling deeply, rising after the lowest point of 5282 and adjusted narrowly in the afternoon. 2501 contracts range from 5282 to 5398 throughout the day, with a spread of 116,01contract reducing 24397 positions. So far, 1024961 positions have been held, 2505 contracts closed at 5573, and positions are 126540.

PVC Future Forecast:

In terms of futures:The operating low of the PVC2501 contract price is 5282, successfully refreshing the position before the main contract low of 5299, the operation of the futures disk price is obviously weak, the short position in the million positions is still dominated by the short position, and the operation of the futures price on Friday shows a cross star positive column, the disk face is slightly reduced, the technical level shows that the Bollinger belt (13, 13, 2) three-track opening is all turned down, and the daily line KD line and MACD line continue to show a dead-fork trend. At the technical level, the take-up lines are still arranged short. At present, the lack of support from the fundamentals, coupled with the macro level is not guided, weak fundamentals lead to the continuous empty allocation of PVC futures, the operation of futures prices in the short term or continue to test the low range, we maintain the previous point of view and observe the support performance of the low range 5280-5350.

Spot aspect:First of all, from the current time stage, in early September, the overall commodity market still did not show cash nine silver ten expectations, but run the mood is empty downward, PVC is weak in the weak, the current PVC fundamentals, strong supply, weak demand and high inventory constraints make PVC is long-term empty allocation, the two cities are now falling endlessly. But so far, the futures price has fallen below the previous low, and the spot market has also been hit back to the low range, but the market continues to have a certain operational risk, so the market has shown a certain exit performance after millions of positions. The focus of the outer disk is on the Fed's interest rate cut, with international oil prices remaining at a 14-month low on crude oil, as concerns about oil demand and a possible increase in supply in Libya offset a sharp decline in US crude stocks and delays in production by OPEC+ producers. On the whole, it is difficult for PVC to get rid of the weak situation in the short term, but it continues to narrow the blanking space.