PVC: The overall futures price is above the middle rail, and the technical closing line is golden. Formosa Plastics 'quotation price has been significantly reduced.

PVC Futures Analysis:V2501 contract opening price: 5684, highest price: 5691, lowest price: 5614, position: 839783, settlement price: 5655, yesterday settlement: 5594, up 61, daily trading volume: 1058639 lots, precipitated capital: 3.333 billion, capital inflow: 107 million.

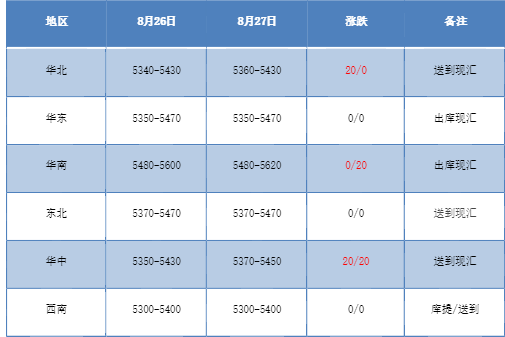

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction prices in China's PVC market were adjusted flexibly, and some prices rose slightly. Compared with the valuation, the low end of North China rose 20 yuan / ton, East China was stable, South China's high end rose 200 yuan / ton, Northeast China was stable, Central China rose 20 yuan / ton, and Southwest China was stable. The ex-factory price of upstream PVC production enterprises began to tentatively increase the quotation of 20-30 yuan / ton, including the simultaneous increase of the quotation of remote storage in some northwest regions, and some enterprises still wait and see. The futures are arranged in a high and narrow range, the price of part of the offer in the spot market has been raised, the spot price and the price still coexist, and the basis offer does not change much, including the 01 contract in East China-(250). South China 01 contract-(50), northern 01 contract-(400), southwest part of the low-price supply heard 01 contract-(600). The price increase of production enterprises did not change for better transactions, and the same is true in various consumer areas. Rigid demand procurement is maintained, and there is no obvious volume performance in trading.

From the perspective of futures:The price of the PVC2501 contract reached a peak of 5691 at the start of the night trading, followed by a slight weakening. After the start of morning trading, the futures price was arranged in a narrow range, and the afternoon price rose slightly, returning to the vicinity of the opening price. 2501 contracts fluctuated in the range of 5614-5691 throughout the day, with a spread of 77. 01 contracts with an increase of 25851 positions, with 839783 positions so far, 2409 contracts closing at 5486 and 146652 positions.

PVC Future Forecast:

In terms of futures:The PVC2501 contract price runs above the middle track. From a technical point of view, it has successfully broken through the middle track position, and today's futures price fluctuation range has narrowed and weakened after the emergence of the high position. In terms of transaction, there are still some short orders under the high price, which is 23.4% higher than the short price. However, the current technical closing line is good, and the daily KD line and MACD line continue to show a golden fork trend. The third track of the Bolin belt (13,13,2) narrows, and after the three-track distance is shortened, the fluctuation of the futures price expands or further forms a new trend. in the short term, observe whether the fluctuation of the 2501 contract can effectively step on the position of the middle track. the volatility range of futures prices was observed from 5600 to 5750.

Spot aspect:The spot market performed well during the week, with both low and high prices rising slightly for two consecutive days, but there were no signs of improvement in trading, let alone speculative demand. At present, there is still nothing new in the level of supply and demand. The price of calcium carbide at the cost port of the calcium carbide method has risen slightly recently. In terms of outer crude oil, the oil price has risen by more than 3% because the government of eastern Libya said it would stop oil production and export. and Israel and Hezbollah attacked each other. The government in the east of the country, which controls most of Libya's oil fields, said on Monday that it had declared all oil fields, ports, institutions and facilities in a state of force majeure and would stop oil production and exports until further notice. In addition, today's spot PVC, Formosa Plastics prices from Taiwan, PVC September shipping pre-sale quotation reduced by 50-110USD / ton from the previous month, sent to India to reduce the CIF price by US $110to US $800CFR, sent Chinese mainland to reduce the CIF price by US $50 to US $7805CFR, sent to Southeast Asia to reduce the CIF price to US $805USD CFR, and other regions reduced by US $70per ton. On the whole, the PVC spot market under the current stage still needs to be observed, and the price may continue to be arranged on a small scale.