Methanol: Futures market fluctuated and fell back, and the spot market adjusted within a narrow range

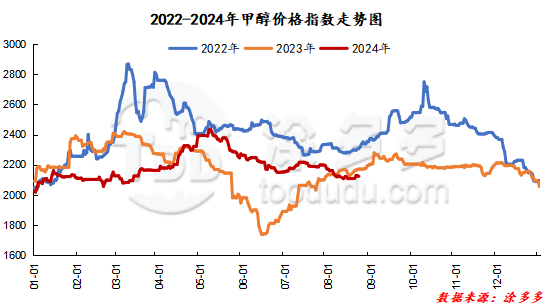

On Aug. 23, the methanol market price index was 2121.24, down 1.83% from yesterday and 0.09% lower than yesterday.

Outer disk dynamics:

Methanol closed on August 22:

China CFR 294-296 US dollars / ton, up 1 US dollars / ton

Us FOB 105-106cents per gallon, flat

CFR in Southeast Asia: us $345-346 per ton, Ping

European FOB 336-337 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2170-2200 (0), North: 2020-2065 (0), South: 2050 (0), Lunan: 2370 (0), Henan: 2290-2295 (- 20), Shanxi: 2160-2270 (0), Port: 24602470 (- 15)

Freight:

North Route-Northern Shandong 240-290 (0ram 0), Northern Route-Southern Shandong 320-340 (0amp 0), Southern Route-Northern Shandong 250-280 (0max 0), Guanzhong-Southwest Shandong 180-240 (0max 0)

Spot marketToday, the methanol market price is adjusted in a narrow range, the futures market fluctuates, and the market negotiation atmosphere is limited. at present, the main downstream demand has improved, supporting some regional manufacturers to raise their quotations, but the traditional downstream market is still in the off-season of consumption. the rigid demand of the industry is mainly replenishment. Specifically, the market prices in the main producing areas are operating steadily, with the quotation on the southern route around 2050 yuan / ton and the northern line around 2020-2065 yuan / ton, maintaining yesterday, the market demand in the lower reaches of the region has improved, supporting manufacturers to price at a high level to a certain extent. The market prices in Shandong, the main consumer area, are arranged in a narrow range, with 2370 yuan / ton in southern Shandong and 2330-2350 yuan / ton in northern Shandong. Part of the downstream maintains low prices and rigid demand is mainly purchased, and some operators have an obvious wait-and-see mood towards the future. The market quotation in North China has been raised narrowly. Hebei quotation is 2260-2340 yuan / ton today, while that of some methanol enterprises in the region is adjusted narrowly; Shanxi quotation today is 2160-2270 yuan / ton, maintaining yesterday, with the parking and overhaul of the device, the supply of goods available in the market in the region has been reduced, and the supply side is favorable to support manufacturers' price-raising mentality.

Port marketToday, methanol futures range fluctuates. During the month, the rigid demand replenishment delivery, the basis is stable; the long-term arbitrage operation is mainly, a small amount of unilateral higher, the basis is slightly weaker. The monthly difference narrowed slightly and the overall transaction was mediocre. Taicang main port transaction price: 8 lower deal: 2460-2470, base difference 01-32 lemme 29th 9 lower transaction: 2485-2500, base difference 01-5 lemme 2x 10 deal: 2515, base difference 01x 27.

Future forecast:Recently, the start-up of the Chinese market has declined compared with the previous period, and with the strong volatility of the futures market, the trading atmosphere in the market has improved, and there is still some support on the supply side in the short term. From the demand point of view, the Jiutai olefin plant has resumed operation, Tianjin Bohua continues to extract, the main downstream demand performance is good, and with the arrival of the "Jinjiu Silver 10", some of the downstream has a certain low replenishment operation, but considering that the traditional downstream starts to resume slowly, it suppresses the spot market price to a certain extent. Overall, the short-term methanol market price is expected to be strong and volatile, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.