[Natural Rubber]: Rubber Daily Journal (August 23)

Analysis of natural rubber market price on August 23

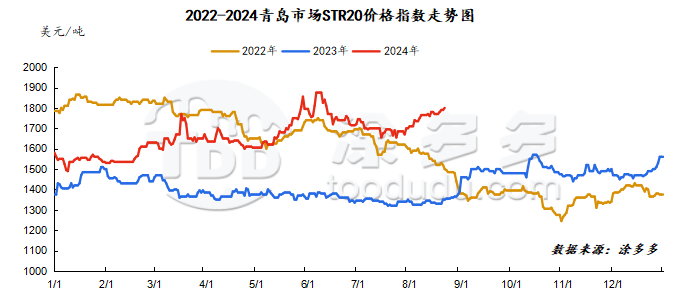

index

August 23June, Natural Rubber Qingdao Market STR20 Price Index1800 USYuan/ton, compared withThe previous trading day rose by US$10/ton.

market analysis

market analysis

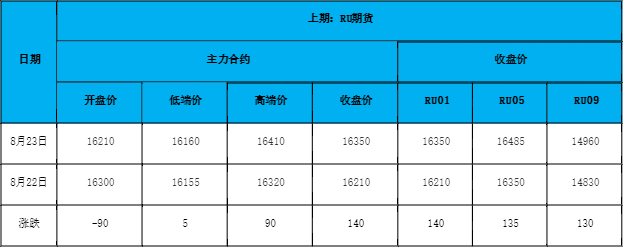

futures market

spot market

Supply:

Foreign: Precipitation in southern Thailand is still in a high trend, disrupting rubber tapping work in some areas, and the overall supply shows a small month-on-month increase. However, as the rainfall eased, the amount of raw materials was significantly increased. As the demand for overseas replenishment cooled, there was room for reduction in raw material prices.

China: Currently, Yunnan production has been fully cut, but there are frequent rains and weather, falling leaves have occurred in some areas, and raw material prices have remained high.

The weather in Hainan's production areas has eased, the amount of raw materials stored is expected, and the actual purchase price of raw materials has not changed significantly yet.

Demand side:The capacity utilization rate of some maintenance companies is gradually recovering, which will give a certain boost to the overall start-up. Recently, factory shipments have been average, inventory digestion is limited, and inventory is still gradually improving. In terms of the market, the downturn in real estate and infrastructure has affected the demand for all-steel tires. There are more and less work for medium and long-distance vehicles. The profits of the fleet have further declined. Replacement demand has weakened. The overall market demand is insufficient. Although the overall increase has been slightly compared with the previous month in the near future, the overall improvement has been limited. Some agents have high inventories and slow de-warehousing.

Futures spot price list

market outlook

Recently, the trend of improving the main rubber contract has become clear. The main contract has basically remained at around 16100 yuan/ton, and the market bull sentiment has begun to heat up. As of now, due to weather and other reasons, the overall cutting situation in the main natural rubber producing areas outside China has fallen short of expectations, which supports the fact that the current raw material prices remain at a high level to a certain extent, and cost support still exists. However, recently, in the seasonal peak production period of natural rubber, new rubber production continues to be released from expectations and is still stored, and raw material prices are still under pressure in the later period. The overall demand in the demand-side market is insufficient. Although there has been a slight increase compared with the previous month in the near future, the overall improvement is limited. The current pressure on inventories is still relatively high. The overall destocking continues, but the speed needs to be improved. The market has long and short signals, and rubber prices continue to fluctuate mainly.