Soda ash: Is the market price expected to fall to a new low in the past two years?

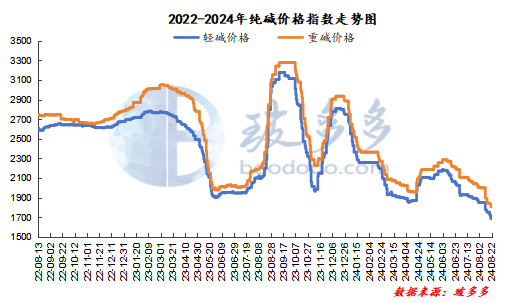

According to Bodo data, the price of China's soda ash market continued to decline from June to August in 2024, and the spot market entered a long bear market, which has continued to this day. In late August, the price of soda ash fell to a lower level during the year. At present, some market prices hover around 1300-1500 yuan / ton.Fall toA new low in the past two years. The price of soda ash market is still in the process of going down, the supply of goods at low prices is increasing, and the profit space of the industry is constantly narrowing.Due to the continuous decline in prices, the enthusiasm of enterprises in the middle and lower reaches to take goodsParallelNot high, for the future price trendHoldCautious attitudeThe overall situation of receiving orders from soda ash manufacturers is not good, and the number of orders to be issued is lower than that of the previous month.

According to previous years, July-AugustForTraditional maintenance season in soda ash industryAnd as can be seen from the following picture, AugustAlthoughSome alkali plants are reduced and overhauled, but there is no phenomenon of large-scale overhaul, which breaks the previous seasonal fluctuation law, and the output loss caused by overhaul is not as expected. In addition, the soda ash industry has expanded its production capacity since 2024.ObviousThe overall supply has increased, but the maintenance during the year is relatively scattered, which plays a limited role in supporting the market.August 22ndThe overall operating rate of the industry is 82.50%, which is still maintained at a high level, the supply of goods in the market is sufficient, and the supply pressure of manufacturers is rising.

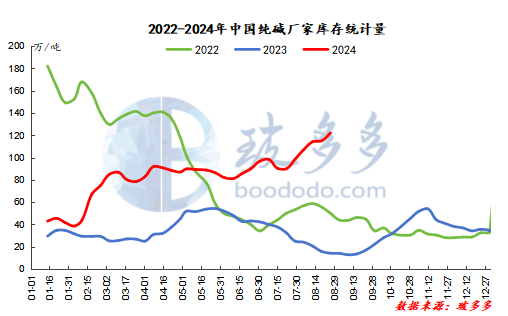

Affected by the weakening of downstream demand, the inventory accumulation rate of soda ash enterprises is significantly accelerated. As can be seen from the chart below, the inventory of soda ash enterprises has been maintained at more than 1 million tons since August and reached 1.22 million tons on the 22nd, an increase of 759.51% over the same period last year, the highest in the same period in nearly three years. Inventory pressure is mainly due to the continued weakness of demand, as the downstream end market further weakens, orders do not see a significant rebound, poor shipments of manufacturers lead to a substantial increase in soda ash enterprise inventory. In the case that the downstream demand can not be effectively boosted, the inventory removal of soda ash enterprises in the later stage may face greater challenges.

Traditional peak season of "Golden Nine and Silver Ten"Coming toAt present, the soda ash market continues to be weak.Downstream procurementStillToLow-cost steelNeed to give priority to, soda ash manufacturers expect to place orders before execution, and the trading atmosphere in the market is relatively low.The wait-and-see mood is still strong..July-AugustPeriodInDouble pressure of demand and costLowerThe profit space of downstream float glass and photovoltaic glass enterprises is very limited, and some enterprises have even lost money and began to speed up the cold repair of production lines, further affecting the demand for soda ash.Under the pressure of high inventory, soda ash manufacturers mainly take orders flexibly, and there is no sign of stabilization in the market for the time being, and some market participants are pessimistic about the future.Of courseThe price of soda ash has fallen to its lowest level in nearly two years, withFollow upThe plant of the alkali plant starts and stops side by side, and the price continues.BeingThe space for divingAndUplink stillBearing pressureIn the short termThe market continued its downward trend, and spot prices basically fell to the cost line.The willingness to replenish the database downstreamOr canWith some improvement, the pressure on soda ash inventory is expected to be alleviated, and the price will be suppressed gradually.ReduceThere is a certain rebound drive in the marketIn the long runWith the end of maintenance one after anotherSoda ash supply growth rateOrThe pattern of overcapacity in the industry that is greater than the growth rate of demandStill exist.Under the restraint of weak downstream demand, the market outlook is hardly optimistic, and the overall profitability of soda ash manufacturers may be further weakened.Soda ash marketUnder the imbalance between supply and demandFollow upCan the traditional peak season bringWarm upWe still need to pay close attention to the operation of the alkali plant.、The strength of downstream demand recovery, the speed of inventory digestion and changes in market sentiment.