PVC: Short futures prices have returned to increase positions downward, mid-track pressure has worked, and the spot market is performing poorly

PVC Futures Analysis:V2501 contract opening price: 5610, highest price: 5620, lowest price: 5524, position: 816850, settlement price: 5561, yesterday settlement: 5691, down 130, daily trading volume: 647059 lots, precipitated capital: 3.169 billion, capital inflow: 115 million.

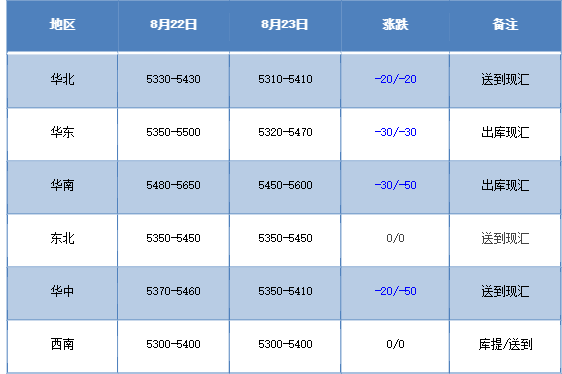

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of China's PVC market has declined slightly, and the market is not running well. Compared with the valuation, it fell by 20 yuan / ton in North China, 30 yuan / ton in East China, 30-50 yuan / ton in South China, stable in Northeast China, 20-50 yuan / ton in Central China and stable in Southwest China. Upstream PVC manufacturers partly cut factory prices by 30-50 yuan / ton, while some remained on the sidelines and encountered downward futures on Friday. Although ex-factory prices have weakened, there are not many contracts signed for a generation, and the market has still not heard of the emergence of hoarding intentions. The futures market weakened obviously, the spot market price quotation decreased yesterday, and the low price increased. After the futures price went down, the spot price had certain advantages over the base difference offer, among which the East China base difference offer 01 contract-(250), the South China 01 contract-(0-50), the northern 01 contract-(420), and the southwestern part of the low-price supply heard 01 contract-(570). Although the basis offer has advantages, but the spot market trading is not good, the return to low prices hit the spot market merchants mentality, downstream inquiry enthusiasm weakens.

From the perspective of futures:The night price of PVC2501 contract weakens slightly, with a low point in the intraday downside. Although the price rose slightly after the beginning of morning trading, the increase was small, and the price continued to adjust in a narrow range in the afternoon, and there was no obvious direction fluctuation at the end. 2501 contracts fluctuated in the range of 5524-5620 throughout the day, with a spread of 96. 01 contracts with an increase of 41029 positions, with 816858 positions so far, 2409 contracts closing at 5375 and 222833 positions.

PVC Future Forecast:

In terms of futures:The operation of the PVC2501 contract price returns to the low range. From the all-day trend, the high point of the futures price on Friday is located below the middle rail position of the Bollinger belt, which forms a pressure level and works. The market transaction opened 25.3% more than the empty opening 24.5%. The technical level shows that the three-track opening of the Bollinger belt (13, 13, 2) began to turn downward, turning from the narrowing trend to the lower track. Up to now, mainly, the position of 2501 contracts has approached a large position, but the recent market trend, although there has been a small rise in the week after bottoming out and rebounding from the low point, the situation of increasing positions and short opening pressure on Thursdays and Fridays in a row has brought expectations to an abrupt end. As a whole, look at the operation of futures prices in the short term or retest the low range, and observe the performance in the range of 5480-5620.

Spot aspect:The downward price of the two cities on Friday brought the spot market atmosphere back to a weak mood. First of all, the upstream inventory could not be digested smoothly. Although calcium carbide enterprises still have maintenance, the overall PVC industry operating load has not changed much after the increase in the operating rate of the ethylene method. Coupled with the weak exports and poor domestic demand, the current social inventory is still high. Therefore, the weak fundamental is that the PVC is empty in the overall plasticizing plate, and there is no sign of change. Although the time has come in late August, the middleman has no intention of hoarding goods, the weak market, and the small continuous rise in the week has also been relinquished by the market on Thursday and Friday. In the outer disk, prices in the international crude oil futures market rebounded after falling for four consecutive trading days, and the higher-than-expected drop in US crude oil inventories last week also supported the oil market and encouraged traders to cover short positions due to geopolitical tensions. Overall, in the short term, under the guidance of no clear positive factors in the PVC spot market, prices will still be mainly adjusted in a narrow range and low level.