Daily Review of Urea: The incremental market for low-cost corporate receipts ushered in a slight rebound (August 22)

China Urea Price Index:

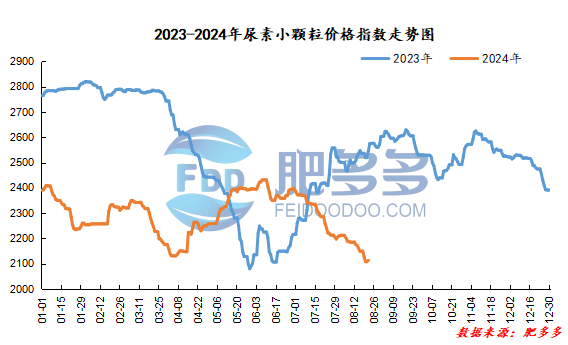

According to Feiduo data, the urea small pellet price index on August 22 was 2,112.82, an increase of 5.00 from yesterday, a month-on-month increase of 0.24% and a year-on-year decrease of 16.97%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1905, the highest price is 1922, the lowest price is 1886, the settlement price is 1907, and the closing price is 1891. The closing price is 13 lower than the settlement price of the previous trading day, down 0.68% month-on-month. The fluctuation range of the whole day is 1886-1922; the basis of the 01 contract in Shandong is 169; the 01 contract has increased its position by 7162 lots today, and so far, it has held 150741 lots.

Today, urea futures prices are mainly weak and volatile. Recent fluctuations in urea futures prices are mainly due to changes in overall commodity market sentiment. Its own fundamentals are still in a pattern of strong supply and weak demand, and it continues to accumulate significantly during the week. At the same time, prices are strongly suppressed by regulations, and the market's emotional rebound is relatively limited. Although it has boosted the transaction situation in the spot market, its persistence is doubtful. Short-term urea futures prices may remain short, but need to flexibly respond to market emotional trading opportunities.

Spot market analysis:

Today, the transaction atmosphere in China's urea market has improved. Companies have increased their low-priced orders. The market has ushered in a period of rebound. However, due to the continuous increase in industry supply pressure, the market has been restricted, and prices are mainly weak and volatile.

Specifically, prices in Northeast China have stabilized at 2,100 - 2,130 yuan/ton. Prices in East China rose to 2020-2080 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,030 - 2,250 yuan/ton, and the price of large particles rose to 2,130 - 2,180 yuan/ton. Prices in North China rose to 1,930 - 2,120 yuan/ton. Prices in South China rose to 2,150 - 2,240 yuan/ton. Prices in Northwest China fell to 2,080 - 2,130 yuan/ton. Prices in Southwest China fell to 2,050 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, after the price cut, the transactions at the low-end prices of enterprises in the main production and sales areas increased significantly. Orders to be issued were accumulating one after another. Manufacturers received better orders, and some offers increased slightly, which led to a slight shift in the focus of on-site discussions. Currently, stable prices are mainly shipped. In terms of the market, market transactions have increased, the focus of negotiations has slightly increased, and prices have rebounded. Currently, some middlemen are following up on bottom-hunting, and the trading atmosphere on the floor is strong, and the sentiment of operators has been boosted. On the supply side, maintenance equipment resumed production one after another within the week, and the supply side once again tends to be loose. Currently, Nissan and inventory are accumulating simultaneously, and the fundamentals are weak. On the demand side, downstream purchases at low prices have increased, and industry operators are still cautious in following up. There is still resistance to the delivery of finished products from compound fertilizer factories. They maintain a cautious wait-and-see attitude towards the procurement of raw materials. Some of them are used as they are, and follow-up is limited.

On the whole, the current number of new orders in the urea market is increasing, the market is improving, and there may be signs of follow-up slowing down in the later period. In the short term, the market is mainly pushing up within a narrow range. It is expected that the price increase in the urea market will gradually narrow in a short period of time. We need to continue to pay attention to the follow-up situation of autumn fertilizer and winter storage.