Daily Review of Urea: The increase in low-price transactions in the market is obvious, and corporate offers rebounded slightly (August 21)

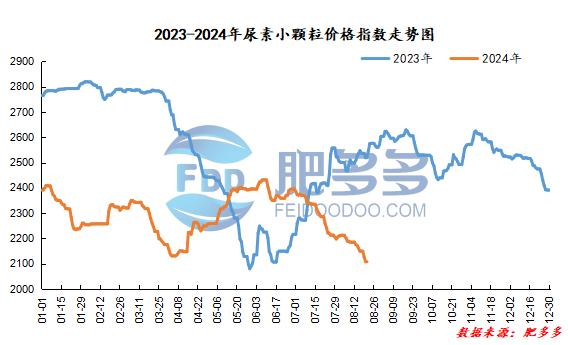

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on August 21 was 2,107.82, an increase of 0.27 from yesterday, a month-on-month increase of 0.01% and a year-on-year decrease of 16.43%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1897, the highest price is 1917, the lowest price is 1886, the settlement price is 1904, and the closing price is 1907. The closing price has increased by 37 compared with the settlement price of the previous trading day, up 1.98% month-on-month. The fluctuation range of the whole day is 1886-1917; the basis of the 01 contract in Shandong is 133; the 01 contract has reduced its position by 8953 lots today, and so far, it has held 143579 lots.

Today's urea futures prices are generally strong and volatile. Recently, affected by policy news, the overall commodity market has experienced an emotional rebound, driving the urea market to operate strongly. After the main contract has been moved for a long time, the proportion of expected transactions has gradually increased, and the market is more sensitive to stories to tell. However, given the special nature of urea varieties, upward pressure is still high, and the sentiment for follow-up is relatively limited. In the short term, we need to pay attention to the continued issue of the recovery of macro sentiment in the commodity market and whether the downstream purchasing sentiment in the spot market can be improved after the rebound.

Spot market analysis:

Today, low-price transactions in China's urea market have increased one after another. Factory offers have increased based on the increase in new orders. Manufacturers are obviously willing to support prices. Most of the quotations today are mainly small increases.

Specifically, prices in Northeast China fell to 2,100 - 2,130 yuan/ton. Prices in East China rose to 2,000 - 2,080 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2020- 2,250 yuan/ton, and the price of large particles has stabilized at 2,100 - 2,180 yuan/ton. Prices in North China fell to 1,920 - 2,120 yuan/ton. Prices in South China fell to 2,160 - 2,220 yuan/ton. Prices in Northwest China fell to 2,100 - 2,150 yuan/ton. Prices in Southwest China are stable at 2,070 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, after the continuous decline in manufacturers 'quotations in recent days, orders for low-end quotations in mainstream areas have increased, follow-up of new orders has increased slightly, and manufacturers have increased their willingness to support prices. Based on this price increase today, the market offer may be expected to rebound slightly in the short term. In terms of the market, after the market quotation fell, the transaction price of low-priced goods improved. The atmosphere in the venue was slightly boosted compared with the previous period. The sentiment rose significantly, and market transactions increased one after another. However, the overall mentality was still mostly cautious, and the situation was temporarily deadlocked. In terms of supply, supply and demand are expected to increase. Currently, Nissan is improving slowly, and the amount of goods available in the market is increasing one after another. On the demand side, downstream merchants are following up on dips in appropriate amounts, and some mentality is still waiting to see. On the demand side, follow-up is cautious, and the overall volume is relatively limited.

On the whole, the current increase in low-price transactions in the urea market is increasing, new orders from companies are following up, and quotations are rising slightly. However, in the long run, the support for the market is limited. It is expected that the urea market price will continue to stabilize and consolidate after a slight increase in the short term.