Float glass market prices continue to fall

Float glass market prices continue to fall

Float glass market price

Analysis of float glass market

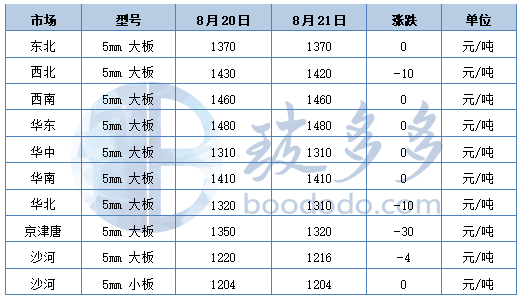

Today, China's 5mm float glass market continues to be weak. Among them, float glass market prices in North China have continued to fall, terminal demand is weak, and the purchasing atmosphere is poor; prices of glass manufacturers in the Beijing-Tianjin-Tangshan region have been lowered by 30 yuan/ton to 1320 yuan/ton, and the focus of transactions has further shifted; Shahe region 5mm large plate float glass prices continue to fall; recent production and sales performance in the northwest region has been weak, and corporate quotations are still bottoming out slightly; glass companies in other regions have followed the market and made flexible quotations. At present, downstream demand in the float glass market is still weak and has not seen significant improvement. The supply and demand situation is still excessive, and the overall macro sentiment is relatively low.

Float Glass Index Analysis

According to data from Boduo, the float glass price index on August 21 was 1,285.11, down 4.24 from the previous working day, with a range of-0.33%.

Futures dynamics

Futures dynamics

According to data from Boduo, the opening price of FG2501, the main glass contract, on August 21, was 1305 yuan/ton, and finally closed at 1323 yuan/ton, an increase of 2.80% within the day. The intraday high was 1325 yuan/ton, the lowest was 1264 yuan/ton, holding 650243 lots, a month-on-month period of 12540 lots.

Glass futures prices rose sharply today, mainly due to policy news and the overall commodity market's emotional recovery. At present, the fundamentals of the spot market are still difficult to improve significantly, but the proportion of expected transactions has increased after the main futures contract has moved far into the future. At present, glass futures prices have fallen below the cost line and have entered the early stage of production capacity clearing. The supply in the future is expected to be marginally positive. On the demand side, there are also boost points such as macro policy expectations. In the short term, we need to pay attention to the persistence of this round of macro emotions and the implementation of policy news.

market outlook

The float glass market supply remains at a relatively high level, but the downstream demand boom continues to decline; before a new round of replenishment demand is released, it is expected that spot market prices will continue to consolidate within a narrow range in the short term.