[Natural Rubber]: Rubber Daily Journal (August 21)

Analysis of natural rubber market price on August 21

index

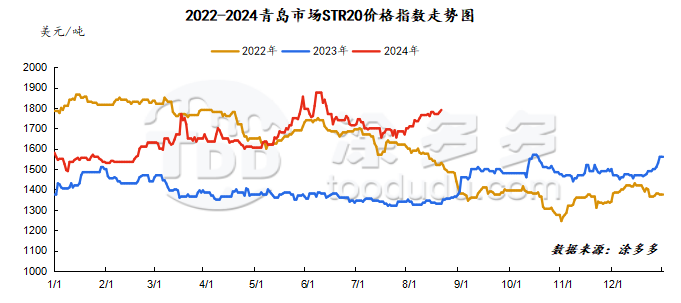

August 21June, Natural Rubber Qingdao Market STR20 Price Index1790 USYuan/ton, compared withThe previous trading day rose by US$10/ton.

market analysis

market analysis

futures market

spot market

Supply:

Foreign: Precipitation in southern Thailand is still in a high trend, disrupting rubber tapping work in some areas, and the overall supply shows a small month-on-month increase. However, as the rainfall eased, the amount of raw materials was significantly increased. As the demand for overseas replenishment cooled, there was room for reduction in raw material prices.

China: Currently, Yunnan production has been fully cut, but there are frequent rains and weather, falling leaves have occurred in some areas, and raw material prices have remained high.

The weather in Hainan's production areas has eased, the amount of raw materials stored is expected, and the actual purchase price of raw materials has not changed significantly yet.

Demand side:There are sufficient foreign trade orders, coupled with China's snow tire scheduling period, the capacity utilization rate of semi-steel tire companies has remained high. Recently, China's overall shipment performance has been average. Due to production scheduling problems, some products are still out of stock. In terms of the market, agents in Heilongjiang, Jilin and other regions have successively submitted orders for snow tires. This year, the company's delivery situation is still good. However, the company's production capacity supply is tight, and some brands in the market are still out of stock. Considering that some operators are bearish on the future outlook, the market is more cautious in replenishing goods.

Futures spot price list

market outlook

Recently, the main rubber contract has been firm at 10,000 yuan. So far, the rainfall in Thailand in the upstream producing areas has not been limited alleviated, and the output of raw materials still has an impact. Yunnan's production areas have fully entered the rubber tapping season. However, frequent rainfall has caused certain interference to production, and even fallen leaves have occurred in some areas, exacerbating supply constraints and supporting upstream prices. The start-up utilization rate of downstream maintenance companies has gradually recovered, but the overall shipment performance is average and the performance of new orders is differentiated. However, in order to meet customer demand, the start-up is expected to improve slightly in the short term, which will boost the demand for natural rubber to a certain extent. In terms of inventory, the current pressure is still relatively high, and the overall destocking continues, but the speed needs to be improved. The market has long and short signals, and rubber prices continue to fluctuate mainly.