Daily Review of Urea: The market lacks positive support and prices have reached this year's lows (August 20)

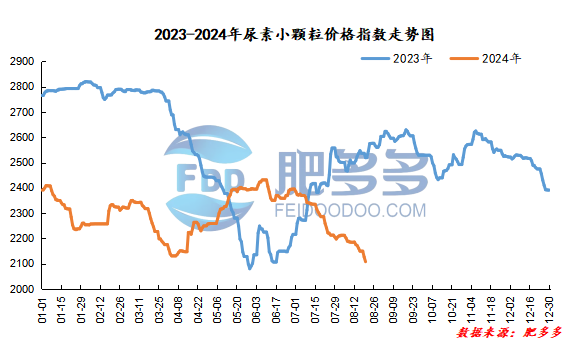

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on August 20 was 2,107.55, a decrease of 18.64 from yesterday, a month-on-month decrease of 0.88% and a year-on-year decrease of 16.34%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1865, the highest price is 1889, the lowest price is 1858, the settlement price is 1870, and the closing price is 1885. The closing price is 16% higher than the settlement price of the previous trading day, and the month-on-month increase is 0.86%. The fluctuation range of the whole day is 1858-1889; the basis of the 01 contract in Shandong is 150; the 01 contract has lightened its position by 6690 lots today, and so far, it has held 152532 lots.

Today, the overall price of the main contract of urea futures fluctuated mainly within a narrow range, and rose slightly in late trading due to the overall market environment. The fundamentals of urea itself are still in a pattern of strong supply and weak demand, and there has been no significant improvement for the time being. Manufacturers still focus on lowering prices to reduce inventory pressure. The futures market also lacks its own drive, but the overall commodity market environment shows signs of recovery in the short term. It is necessary to continue to observe whether the macro environment can stabilize to drive the sentiment in the urea period spot market.

Spot market analysis:

Today, the domestic urea market price continued to be weak and lower, and the market price had reached a low point. However, the transaction of new orders showed no obvious signs of improving. The increase in new orders in the market was not obvious. The short-term market was mainly weak and deadlocked.

Specifically, prices in Northeast China fell to 2,100 - 2,140 yuan/ton. Prices in East China fell to 2,000 - 2,070 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,000 - 2,250 yuan/ton, and the price of large particles fell to 2,100 - 2,180 yuan/ton. Prices in North China fell to 1,900 - 2,140 yuan/ton. Prices in South China fell to 2,170 - 2,210 yuan/ton. Prices in Northwest China fell to 2,100 - 2,160 yuan/ton. Prices in Southwest China are stable at 2,070 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, the acquisition of new orders is not good, and the sales pressure of manufacturers has increased. Factory quotations in some mainstream regions have dropped to low levels, and offers have dropped significantly. However, the follow-up of new orders is still not as expected. In the short term, manufacturers have reduced price adjustments, and their mentality is biased towards caution. In terms of the market, the market trading atmosphere is still weak, and the market is sluggish and has no change. Downstream operators are cautious in following up and trading in the market is limited. Although the current market price continues to decline, the overall transaction has not shown any obvious signs of improvement. In the short term, the market continues to be weak. On the supply side, early maintenance equipment is being restored one after another, and market supply pressure is gradually increasing. The industry's daily output has rebounded in a narrow range, which has a negative impact on the supply side. On the demand side, the demand side is increasing slowly. Downstream compound fertilizer factories are cautious about purchasing raw materials and are pessimistic. Actual follow-up is limited, which temporarily cannot support the market. Subsequent market price lows may occur appropriate follow-up behavior.

On the whole, the current urea market supply and demand are both weak, there is no good price support, and the market is weak downward. It is expected that the urea market price will continue to consolidate downward in a short period of time, and the range will gradually shrink.