PVC: The futures price closed at the cross star, the 01 contract increased significantly, and there was a difference in the spot offer

PVC Futures Analysis:V2501 contract opening price: 5575, highest price: 5626, lowest price: 5550, position: 687690, settlement price: 5579, yesterday settlement: 5566, up 13, daily trading volume: 517828 lots, precipitated capital: 2.696 billion, capital inflow: 312 million.

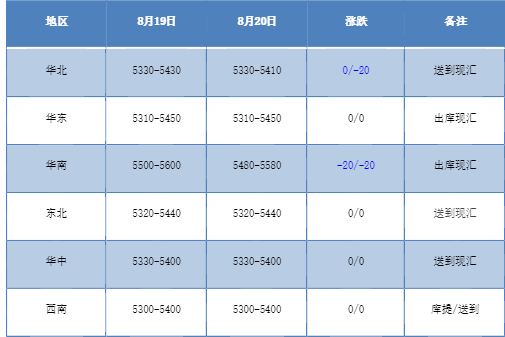

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction prices in the domestic PVC market are mainly adjusted flexibly, and some of them yield a certain profit. Compared with the valuation, the high end of North China fell 20 yuan / ton, East China stable, South China 20 yuan / ton, Northeast China stable, Central China stable, Southwest stable. The ex-factory prices of upstream PVC production enterprises remain stable, individual production enterprises tentatively raise their quotations by 30 yuan / ton, and the contract is mainly based on basic quantity. So far, they have not heard of the emergence of low-price hoarding intention. The price offer in the spot market remains weak, there is a certain differentiation in the offer price, there is some room for negotiation in some offers, and the low price in some areas has been reduced. There is no obvious change in basis, including 09 contract-(50-100) or 01 contract-180 in East China, 01 contract-(0-50) in South China, 09 contract-(200-300) or 01 contract-400 in North China. There is no basis offer in Southwest China for the time being. Overall, the spot market transactions still maintain rigid demand, downstream procurement enthusiasm has not been significantly improved.

From the perspective of futures:The night price of the PVC2501 contract rose to the day's highest point of 5626, followed by a slight decline. After the beginning of morning trading, the futures price fell slightly and entered the trend of shock consolidation, and the price rose in the late afternoon but did not reach an overnight high. 2501 contracts fluctuated in the range of 5550-5626 throughout the day, with a spread of 76. 01 contracts with an increase of 78367 positions, with 687690 positions so far, 2409 contracts closing at 5437 and 371650 positions.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2501 contract shows a cross, and the fluctuation range of the futures price has narrowed somewhat. The trading volume is 28.2% more than the empty opening 27.4%, which is still slightly better. The 01 contract increases the position by more than 78000 hands, and the 09 contract reduces the position by more than 85000 hands, showing an obvious market of changing positions and changing months. From the opening and closing trend of futures prices, the direction of changing positions and changing months is not clear. The volatility of the futures price is still hovering at the low level, and the current market has not shown the peak season expectations. The technical level shows that the opening of the three tracks of the Bolin belt (13, 13, 2) is obvious downward. In the short term, the operation of futures prices we still maintain the previous point of view, 2501 contracts to observe the low range of 5500-5670 range performance.

Spot aspect:In the market of changing positions for months, the two recent futures markets began to show a trend of low sideways. First of all, futures positions are moving from 09 contracts to 01 contracts, so it is suggested that 09 contracts should leave as soon as possible. 09 contracts dominated by short positions are expected not to perform well even if they rebound before the end. Secondly, the spot market still faces the problem of high inventory. In terms of PVC fundamentals, the price of calcium carbide has dropped 50-100 yuan / ton in an all-round way, the low price has reached 2400 yuan / ton, and the cost support of PVC has weakened. Secondly, although the equipment has been overhauled recently, the supply is still slightly abundant, and the problem of high inventory has not been solved for a long time, and the digestion speed of supply in the spot market of PVC is slow. After the import and export data were released, it showed that the export volume dropped sharply from the previous month. Therefore, the fundamentals of supply and demand are weak to put pressure on the prices of the two markets in the short term, and it is difficult to find good in the short term, and it is difficult to change the situation of low consolidation in the spot market of PVC.