PVC: The low futures price was slightly restored upward, the 01 position exceeded the 09 contract, and the low spot price decreased and increased

PVC Futures Analysis:V2501 contract opening price: 5509, highest price: 5607, lowest price: 5499, position: 609323, settlement price: 5566, yesterday settlement: 5545, up 21, daily trading volume: 566762 lots, precipitated capital: 2.384 billion, capital inflow: 266 million.

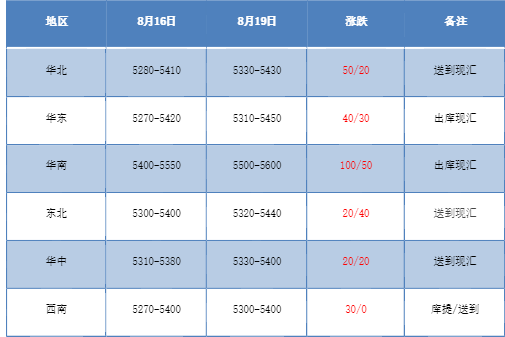

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction prices in the domestic PVC market have been adjusted slightly, with some tentative increases. Compared with the valuation, North China rose 20-50 yuan / ton, East China increased 30-40 yuan / ton, South China rose 50-100 yuan / ton, the low end of Northeast China rose 20-40 yuan / ton, Central China increased 20 yuan / ton, and Southwest China rose 30 yuan / ton. Most of the factory prices of upstream PVC production enterprises remained stable at the beginning of the week, individual enterprise prices increased slightly by 20 yuan / ton, futures disk prices rose slightly and repaired, spot prices and one-mouthed prices coexisted, compared with last Friday's spot market low prices decreased, a small upward trend. Most of the basis offers turn to 01 contracts, including 09 contracts-(50-100) or 01 contracts-180 in East China, 01 contracts-(0-50) in South China, 09 contracts-250 or 01 contracts-400 in North China, and no basis offers in Southwest China for the time being. On the whole, it coincides with the beginning of the week, although the futures price has risen, and there is also a certain upward intention in the spot market, the trading situation is not good, and the downstream is not active in taking goods.

From the perspective of futures:PVC2409 contract night trading price began to rise from the lowest point, the overall night trading rose well, the futures price began to push up the 5400 mark. After the start of morning trading, the price is mainly arranged in a narrow range, and it still fluctuates in a small range in the afternoon. 2409 contracts range from 5327 to 5423 throughout the day, with a spread of 96 .09 contracts reducing positions by 92565 lots, with positions so far of 456663 lots, 2501 contracts closing at 5589, and positions of 609323 hands.

PVC Future Forecast:

In terms of futures:With the passage of time, the current position in 2501 contracts exceeds 2409 contracts, and the change of main force is expected to be completed soon. The operation of the futures price of the PVC2501 contract has been slightly repaired from the low point, and the market has increased its position by more than 60,000 in a single day. In terms of transaction, the opening of 28.7% is higher than that of the empty opening of 24.8% of the 2501 contract. Although the volatility of futures prices has not changed much from last Friday, the opposite trend is positive. Technical level shows that the Bollinger belt (13, 13, 2) three-track opening is still downward, 2501 contract daily line level MACD line dead fork trend shrinks. From the one-day trend, the operation of futures prices in the short term may have a tendency to stop falling, and observe the performance of the low range of 2501 contracts in the range of 5500-5650 in the short term.

Spot aspect:Although there are signs of repair in the prices of the two cities at the beginning of the week, the current market is not stable. first of all, in the market of changing positions and changing months, the trend of futures prices has been hit the lowest in recent years, and has continued to fall, and some factory prices in the spot market have fallen below the 5000 mark. In the overall plasticizing plate, the empty distribution of PVC is relatively obvious, although the fundamentals are weak, but it has become a consensus that the valuation of PVC is on the low side. In the case of strong term linkage, the spot market factors are more difficult to guide price fluctuations, so even the PVC loss can not support the upward price. After the completion of the change in the main contract, there are more expectations of gold, silver and silver in the market, so the current two cities can not place excessive hopes on the real estate policy measures under the current time node can not boost the commodity market, the PVC spot market may still be low in the short term, waiting for the emergence of factors.