PVC: The futures price was sorted out at a low level, the contract change from 09 to 01 continued, and the spot price was slightly higher

PVC Futures Analysis:V2409 contract opening price: 5332, highest price: 5412, lowest price: 5328, position: 549228, settlement price: 5368, yesterday settlement: 5357, up 11, daily trading volume: 681756 lots, precipitated capital: 2.055 billion, capital outflow: 176 million.

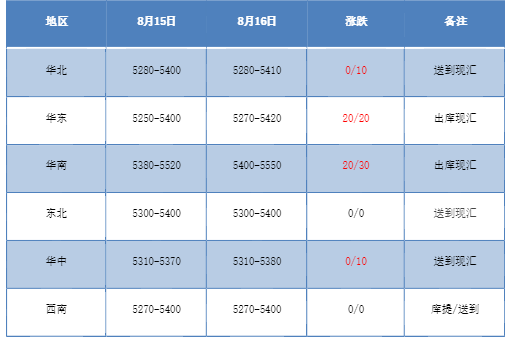

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction prices in the domestic PVC market are adjusted flexibly, and the market prices are tentatively raised. Compared with the valuation, the high-end rose 10 yuan / ton in North China, 20 yuan / ton in East China, 20-30 yuan / ton in South China, stable in Northeast China, 10 yuan / ton in Central China and stable in Southwest China. The ex-factory prices of upstream PVC production enterprises coincided with no obvious adjustment trend on Friday, and most of them remained stable. The futures market first rose and then fell, so there was a difference in the spot market quotation. In the morning, some of the prices were as high as 10-20 yuan / ton, the spot price and one-mouthed price still coexisted, and the basis offer began to turn to 01 contract. Among them, 09 contract-(50-100) or 01 contract-180 in East China, 01 contract-(50) in South China, 09 contract-250 or 01 contract-400 in North China. Southwest 09 contract-480 or 01 contract-620. On the whole, there are some small negotiations in the spot market today, the purchasing enthusiasm in the lower reaches has declined, there are not many price inquiries, and the spot transaction is not good.

From the perspective of futures:The price of the PVC2409 contract opened at a low of 5328 in night trading, then rose slightly. Prices continued to rise slightly after the start of morning trading, but did not rise much and then fell, and prices weakened further in the afternoon. 2409 contracts range from 5328 to 5412 throughout the day, with a spread of 84. 09 contracts reducing positions by 48371 positions, with 549228 positions so far, 2501 contracts closing at 5518, and positions of 548382 hands.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2409 contract is relatively low and narrow, and the fluctuation of the 2409 futures price narrows, but compared with yesterday's low, the technical level shows that the opening of the Bollinger belt (13, 13, 2) is enlarged, and the lower rail of the middle rail is obvious downward, showing a positive pillar with a long shadow line on Friday, and the disk continues to show a state of reducing positions. As of now, the positions in 2409 contracts and 2501 contracts are almost the same, and the market for changing positions continues. But at present, in the weak pattern, even the reduction of 09 contract did not promote the price of a small upward repair, the futures market is still weak. We still maintain the previous point of view, observing the support performance of the low position of 2501 about 5500 and 09 about 5300.

Spot aspect:From the current trend of the disk, the low has not been refreshed, changing positions for the month in the market, PVC has been empty. However, after running to the low position, the space to continue downward has narrowed, and the risk has increased, so in the current position, bears are not willing to exert too much pressure, and now the two cities also begin to show a certain wait-and-see mentality. Today's spot market is even tentatively overreported, but the willingness to receive goods downstream is light. From the current supply and demand level, the benefits are difficult to find, downstream demand constraints are relatively obvious, the rebound of the two cities can only rely on policy guidance. Although the valuation of PVC is low and there is no bottom line, the weak fundamentals make it weak to rebound. Although there are gold nine silver ten expectations in the spot market, the high point is suppressed by the weak market, and the PVC spot market is still low and narrow in the short term.