Urea Daily Review: Indian bidding has less impact on the domestic market, and the market continues to be weak and downward (August 15)

Domestic urea price index:

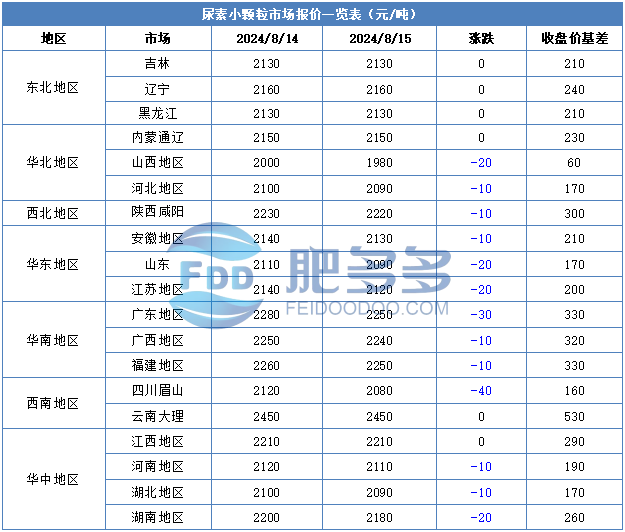

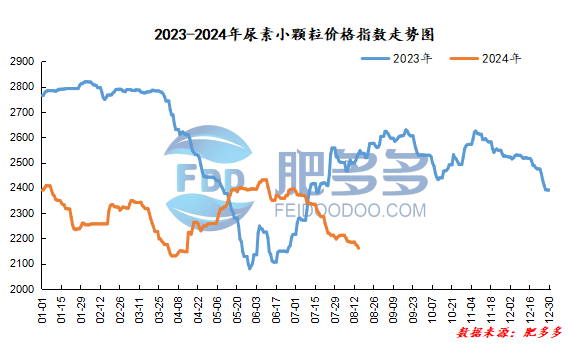

According to Feiduo data, the urea small pellet price index on August 15 was 2,160.91, a decrease of 10.45 from yesterday, a month-on-month decrease of 0.48% and a year-on-year decrease of 14.79%.

Urea futures market:

Today, the opening price of the Urea UR501 contract is 1917, the highest price is 1928, the lowest price is 1892, the settlement price is 1908, the closing price is 8 lower than the settlement price of the previous trading day, down 0.41% month-on-month, and the fluctuation range throughout the day is 1892-1928; the basis of the 01 contract in Shandong is 170; the 01 contract has increased its position by 20492 lots today, and so far, it has held 125416 lots.

Today, urea futures prices mainly fluctuate with the weak market environment. Its own fundamentals are still in a weak reality stage. The supply is generally abundant, the demand side is tepid, and downstream low-price and prudent procurement is the main focus. Although there is emotional cooperation from the news in the short term, it is still difficult to form a sustained positive feedback market, superimposed on the recent commodity market. The overall sentiment of the market is weak, and urea prices may temporarily maintain a weak and volatile pattern waiting for the pace of downstream replenishment.

Spot market analysis:

Today, the overall domestic urea market price dropped slightly. The market lacked the support of positive factors, making it difficult for prices to move upwards. Although Indian bidding information was released yesterday, it did not boost the trading sentiment of domestic companies to a large extent, and market prices continued to move downwards.

Specifically, prices in Northeast China have stabilized at 2,130 - 2,170 yuan/ton. Prices in East China fell to 2,080 - 2,140 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,080 - 2,280 yuan/ton, and the price of large particles stabilized at 2,160 - 2,230 yuan/ton. Prices in North China fell to 1,980 - 2,160 yuan/ton. Prices in South China fell to 2,220 - 2,270 yuan/ton. Prices in Northwest China fell to 2,160 - 2,220 yuan/ton. Prices in Southwest China fell to 2,070 - 2,500 yuan/ton.

Market outlook forecast:

In terms of factories, the transactions of new orders from manufacturers have weakened, and the current orders to be issued are still supported. At the same time, inventories have also increased, making shipments under pressure. Companies continue to cut prices and collect orders, waiting for demand to follow up. In terms of the market, the market trading atmosphere continued to be weak, with the majority of wait-and-see exchanges on the market. The market changed little and there was no significant decline. The actual new orders were mostly followed up by sporadic small orders, and the market continued to be weak for a short period of time. In terms of supply, the industry's supply is gradually improving, the supply increase continues, corporate inventories continue to increase, shipping pressure is gradually emerging, and the supply side tends to be loose. On the demand side, the follow-up demand from downstream compound fertilizer factories is relatively slow, and the trend of demand continues to be weak. The overall follow-up atmosphere is weak. The demand for raw material procurement is delayed, and the overall on-site trading sentiment is not high. In terms of printing and bidding, the Indian NFL released news of the urea import tender, which will open on August 29, and the latest shipping date will be October 31. However, due to the tightening of domestic export policies, most companies have no export plans, which will have a small impact on the market.

On the whole, the current urea market trading is flat and the contradiction between supply and demand is prominent. Although the press announcement was released, the support for the market is poor. It is expected that the urea market price will be stable and weak in a short period of time.