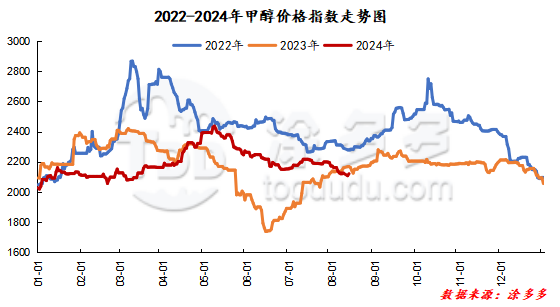

Methanol: Methanol is now recovering strongly and the market trading atmosphere has improved

On August 13, the methanol market price index was 2120.59, up 13.17 from yesterday and 0.62 per cent higher than yesterday.

Outer disk dynamics:

Methanol closed on August 12:

China CFR ranges from US $285 to US $290 per ton, down US $3 per ton

Us FOB 102-103cents per gallon, flat

Southeast Asian CFR 344-345 US dollars / ton, down 1 US dollars / ton

European FOB 326-327 euros / ton, up 3 euros / ton.

Summary of today's prices:

Guanzhong: 2120-2180 (0), North: 2025-2060 (15), South: 2070 (0), Lunan: 2330 (20), Henan: 2270-2295 (10), Shanxi: 2150-2240 (0), Port: 24402460 (30)

Freight:

Northern route-230-290 (0amp 0), northern route-southern Shandong 285-330 (0amp 0), southern route-northern Shandong 250-280 (0max 0), Guanzhong-southwest Shandong 170-240 (0max 0)

Spot marketToday, the methanol market price has slightly increased, the futures market has stopped falling and rebounded, the port spot market price has been adjusted with the market, and the market transaction atmosphere has slightly improved compared with the previous period. The bidding situation of enterprises in Shaanxi and Shanxi is good, and individual enterprises have stopped selling; however, as the terminal market is still weak, the increase in market prices is relatively limited. Specifically, the market prices in the main producing areas have been raised along the way, with the quotation on the southern route around 2070 yuan / ton, the northern line around 2025-2060 yuan / ton, the low end up by 15 yuan / ton, the futures market rising strongly, and the market trading atmosphere has improved. Today, the main enterprises bid for multi-premium transactions, while downstream and traders keep low to fill the gap. Market prices in Shandong, the main consumer area, are arranged in a narrow range, with 2330 yuan / ton in southern Shandong and 2330-2350 yuan / ton in northern Shandong. The main futures market has changed from falling to rising, boosting the mentality of the industry to a certain extent, and the external auction situation is OK, which may lead to an upward trend in Shandong prices. The market quotation in North China is running stably for the time being. Hebei quotation is 2270-2290 yuan / ton today, which is stable. At present, the market demand is narrowing, which drags on the methanol market price. But at present, the main methanol futures market is running strongly, which gives a boost to the methanol spot market and the mentality of operators entering the market. Shanxi quotes 2150-2240 yuan / ton today, the futures market is strong, boosting the enthusiasm of operators to enter the market, so that transaction prices rise within a narrow range, but the downstream demand in most areas is flat, maintaining rigid demand for procurement.

Port marketMethanol futures rebounded strongly today. There are few spot negotiations. There are few spot negotiations. Arbitrage shipments in recent months; forward shipments every high, the basis is weak. The price difference is stable and the transaction is mediocre. Taicang main port transaction price: spot transaction: 2440-2445, base difference 09-5 Maximus 7 position 8-deal: 2440-2460, base difference 09-5pm transaction 8: 2450-2475, basis difference 09-18pm-20cross transaction: 2480-2495, basis difference 09-40Universe 41.

| Area | 2024-8-13 | 2024-8-12 | Rise and fall |

| The whole country | 2120.59 | 2107.42 | 13.53 |

| Northwest | 2025-2180 | 2010-2180 | 15/0 |

| North China | 2150-2290 | 2150-2290 | 0/0 |

| East China | 2440-2520 | 2410-2490 | 30/30 |

| South China | 2435-2500 | 2420-2440 | 15/60 |

| Southwest | 2180-2400 | 2180-2390 | 0/10 |

| Northeast China | 2320-2450 | 2320-2450 | 0/0 |

| Shandong | 2330-2350 | 2300-2330 | 30/20 |

| Central China | 2270-2570 | 2260-2570 | 10/0 |

Future forecast:The target futures market stopped falling but rose, forming a certain support for the mindset of market operators, and some downstream and traders were mainly low-level replenishment, and the overall shipments of manufacturers were OK, supporting some regional market prices to rise slightly, but considering that the downstream of the terminal is still weak and difficult to change, the room for methanol price increase in the mainland market is relatively limited. At present, weak demand still affects the main factors of methanol price trend, and it is expected that methanol market prices will continue to be weak in the short term, but in the later stage, we should pay attention to coal prices, plant operation and downstream demand follow-up.