Urea Daily Review: Downstream follow-up mentality and wait and see corporate quotations continue to be weak and downward (August 7)

Domestic urea price index:

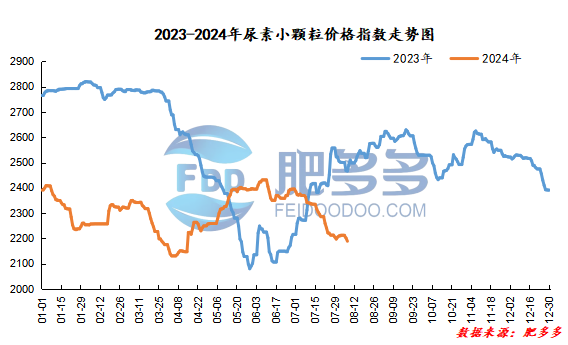

According to Feiduo data, the urea small pellet price index on August 7 was 2,188.64, a decrease of 12.73 from yesterday, a month-on-month decrease of 0.58% and a year-on-year decrease of 11.23%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2025, the highest price is 2032, the lowest price is 2012, the settlement price is 2022, and the closing price is 17% lower than the settlement price of the previous trading day, down 0.83% month-on-month. The fluctuation range of the whole day is 2012-2032; the basis of the 09 contract in Shandong is 78; the 09 contract has reduced its position by 8535 lots today, and so far, it has held 105989 lots.

Today, urea futures prices mainly fluctuate with the weak market environment. Recently, urea itself lacks obvious driving force, and market fluctuations may be more affected by macro sentiments. Overall, the main logic of strong supply and weak demand for urea itself and policy suppression still exist, and the price rise is weak. However, periodic repeated supply and demand problems and the current situation of low inventories in the industry have formed certain support for prices. In the short term, urea has no actual driving or news stimulus, it is difficult to drive the spot market to form continuous positive feedback, and maintain wide fluctuations in the subsequent or following the market environment.

Spot market analysis:

Today, transactions at the low-end of the domestic urea market have increased. Companies have insufficient receipts and continue to cut prices and collect orders. The downstream mentality has a wait-and-see attitude and watch the market more cautiously. The market is in a stalemate.

Specifically, prices in Northeast China have stabilized at 2,150 - 2,190 yuan/ton. Prices in East China fell to 2,090 - 2,170 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,100 - 2,300 yuan/ton, and the price of large particles fell to 2,160 - 2,230 yuan/ton. Prices in North China fell to 2010- 2,200 yuan/ton. Prices in South China fell to 2,260 - 2,320 yuan/ton. Prices in Northwest China fell to 2,210 - 2,300 yuan/ton. Prices in Southwest China are stable at 2,100 - 2,500 yuan/ton.

Market outlook forecast:

In terms of factories, new orders have remained sluggish and unchanged. A few companies have increased their low-priced transactions. Factory quotations continue to show varying degrees of downward adjustment, and reductions are being made, and prices continue to be lowered to attract orders. In terms of the market, market trading sentiment dropped significantly, and operators followed suit. After the price cut, the transaction situation of new orders fell short of expectations. Only a few transactions increased, and the market was sluggish. The downstream continued to wait and see cautiously, waiting for continued low prices to emerge, and the focus of market transactions continued to move down. In terms of supply, some equipment are planned for storage and maintenance in the near future, but the industry's supply is still sufficient and continues. The daily output is maintained at around 180,000 tons, and the supply side has not changed much in the short term. On the demand side, the downstream follow-up mentality continues to be cautious and wait-and-see. The operating rate of downstream compound fertilizer factories continues to rise, and there is a possibility of improvement in the procurement of raw materials. In the future, follow-up expectations are expected to increase.

On the whole, the current number of new orders in the urea market is weak, and some transactions are mostly sold at low prices. The increase in trading activity is limited, and the market continues to be deadlocked. It is expected that the urea market price will continue to be weak and consolidated in the short term, making it difficult to move upwards.