PVC: Futures hit their lowest point in two years and continued to decline. The spot market weakened in the afternoon

PVC Futures Analysis:V2409 contract opening price: 5590, highest price: 5678, lowest price: 5589, position: 780330, settlement price: 5637, yesterday settlement: 5660, down 23, daily trading volume: 761279 lots, precipitated capital: 3.063 billion, capital outflow: 111 million.

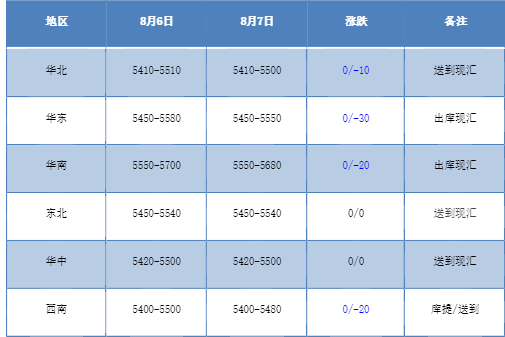

List of comprehensive prices by region: yuan / ton

PVC spot market:There is a certain differentiation in the mainstream transaction price of the domestic PVC market, and the high-end price weakens in the afternoon. Compared with the valuation, the high-end fell by 10 yuan / ton in North China, 30 yuan / ton in East China, 20 yuan / ton in South China, stable in Northeast China, stable in Central China and 20 yuan / ton in Southwest China. Upstream PVC production enterprises factory prices remain stable, individual enterprises slightly reduced 20 yuan / ton. The operation of the futures market is relatively weak, especially after the low point is refreshed again, the overall operation of the spot market is poor, and the morning offer of traders is basically maintained, but there is a certain profit in the afternoon. The basis has not changed much, and most of them are still offered with 09 contracts, including 09 contracts in East China-(100-150-200), 09 contracts in South China-(50-100 and Pingshui, + 20), 09 contracts in North China-(350), and 09 contracts in Southwest China-(250). Although the two quotation methods coexist in the spot market, and the price of the part of the pre-sale source is slightly lower, the purchasing enthusiasm of the lower reaches is not high.

From the perspective of futures:The opening price of PVC2409 contract at night showed its lowest point of 5589, and the low opening price and high moving price slightly repaired the upside. After the start of morning trading, the futures price fluctuated in a small range, and the afternoon price was weak and low. 2409 contracts range from 5589 to 5678 throughout the day, with a spread of 89. 09 contracts reducing positions by 27638 lots, with 780583 positions so far, 2501 contracts closing at 5792, and positions of 332966 hands.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2409 contract has refreshed its low, and the current 5589 has successfully broken the low of 5596 of the main contract in 2023. The weakness of the futures market is relatively obvious, and the problem of reducing positions and changing months begins to appear gradually after entering August, and from the current transaction point of view, the short position reduction and departure has not brought the upward price of futures, on the one hand, it highlights that the role of empty matching remains the same. on the other hand, even if the market comes to the trough, the bulls are not willing to take too much risk. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) narrows, and there is still an empty force on the longer shadow line on the candle map. And the low range of futures prices has been verified in our forecasts, as a whole, the operation of futures prices in the short term will continue to observe the support performance of 5500-5600.

Spot aspect:With the passage of time, the market showed a change of positions for months, but the operation of the stock price in the process of reducing positions is still not good. First of all, in the overall plasticizing plate, the empty distribution of PVC is relatively obvious, and secondly, the overall commodity sentiment today is on the negative side, the main domestic futures contracts rise and fall differently, and most chemical commodities decline. In the outer disk, international oil prices closed higher, rebounding from the previous session's multi-month lows as tensions continued to rise in the Middle East and there were reports that Libya's national oil company was reducing production at the Sharara field as a result of protests. In financial markets, the US stock market rebounded after a sharp fall in global markets. From the current PVC supply and demand fundamentals, PVC plant start-up load has been reduced, but the supply is still abundant, demand constraints are still relatively obvious, so high inventory has always been under pressure in the two cities, PVC spot market prices continue to be low in the short term.