PVC: Futures Masukura has once again entered a trough. Before the main force ended, the spot market weakened

PVC Futures Analysis:V2409 contract opening price: 5665, highest price: 5719, lowest price: 5608, position: 808221, settlement price: 5660, yesterday settlement: 5679, down 19, daily trading volume: 666748 lots, precipitated capital: 3.173 billion, capital inflow: 46.91 million.

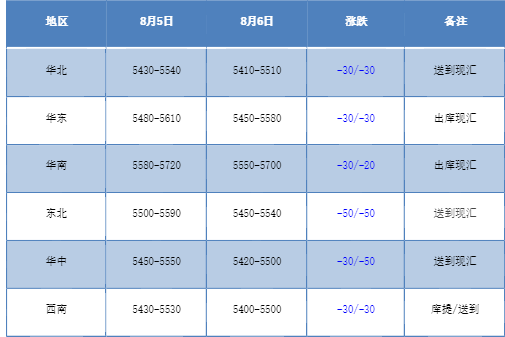

List of comprehensive prices by region: yuan / ton

PVC spot market:Domestic PVC market mainstream transaction prices fell slightly, the market low operation is not good. Compared with the valuation, it fell by 30 yuan / ton in North China, 30 yuan / ton in East China, 20-30 yuan / ton in South China, 50 yuan / ton in Northeast China, 30 yuan / ton in Central China and 30 yuan / ton in Southwest China. There is no obvious adjustment in the ex-factory price of the upstream PVC production enterprises, and the upstream factory does not give more feedback after the futures market weakens, mostly with a wait-and-see mentality. The operating low of the futures price reappears, the price quoted by traders in the spot market is slightly lower than that in the spot market yesterday, the advantage of the low downward price is relatively obvious, the basis adjustment is not much to maintain the early stage, and the spot basis offer is stable today. Among them, 09 contracts in East China-(150-180), 09 contracts in South China-(50-100 and Pingshui, + 20), 09 contracts in North China-(350) Southwest 09 contract-(280). With the futures lower point price offer price advantage appears, but the downstream procurement enthusiasm has not been significantly improved, the overall transaction atmosphere is weak.

From the perspective of futures:The opening price of PVC2409 contract night trading is mainly volatile, and the intraday price has even risen slightly. The futures price showed an obvious weakening trend after the beginning of early trading, and the iterative afternoon price fell further and closed at a low in late trading. 2409 contracts fluctuated from 5608 to 5719 throughout the day, with a spread of 111. 009 contracts reduced their positions by 21209 lots, with 808221 positions so far, 2501 contracts closing at 5796 and 314430 positions.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2409 contract has entered the trough again. After the lowest point of 5601 last week, the lowest point of today's futures price entered the low range again, and the futures price increased positions and fell short obviously. In terms of transactions, the short opening was 25.8% compared with 23.3% more. In the current time point, the overall commodity environment is weak and the financial markets at home and abroad are volatile. On the other hand, the current PVC still faces empty fundamentals. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) turns downward again, and the bears are arranged obviously, and show a negative column with a longer upper shadow line. As a whole, the operation of the price in the short term is observed at the lower support level of 5550-5600.

Spot aspect:At present, the performance of the main contract is weaker than the previous period, the futures price is continuously in the test trough range, and the overall mood is mainly empty in terms of the downward trend of increasing positions, and from the low prices of the two cities, even if there is a certain gold, silver and silver expectations, the expected range will not be too big. From the perspective of futures, the current futures price is highly probable to test the position in the direction of 5500, and at the same time, it is worth noting how to change positions and moon bears leave the market, so although the partial short situation has been determined, there may be a certain risk in the space below. For the spot point of view, the bottom-reading sentiment emerging in the low range in the early stage is not ideal from the current performance. The constraints of high inventory make speculative demand disappear, and there will be the problem of capital occupation in a longer period of time. PVC supply and demand level is still not good to talk about, to maintain the early stage, the overall short-term PVC spot market weak collation.