PVC: Futures fell below the track and hit a new low, increased positions opened empty, and the spot market continued to fall

PVC Futures Analysis:July 30th V2409 contract opening price: 5681, highest price: 5695, lowest price: 5606, position: 894410, settlement price: 5638, yesterday settlement: 5709, down 71, daily trading volume: 701559 lots, precipitated capital: 351.5 billion, capital inflow: 19.52 million.

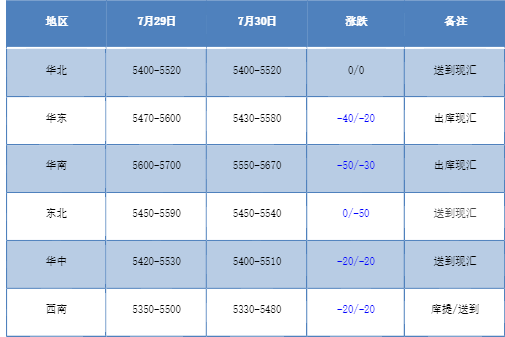

List of comprehensive prices by region: yuan / ton

PVC spot market:Mainstream transaction prices in the domestic PVC market fell slightly and fell endlessly in the spot market. The comparison of valuation shows that North China is stable, East China is down 20-40 yuan / ton, South China is down 30-50 yuan / ton, Northeast China is down 50 yuan / ton, Central China is down 20 yuan / ton, and Southwest China is down 20 yuan / ton. The ex-factory prices of upstream PVC production enterprises are mostly directly reduced by 50 yuan / ton, including synchronous downward price of remote storage, and a small reduction of 20 yuan / ton. So far, the ex-factory quotation has entered the low range at the end of the year. The futures price continued to weaken, the spot market price fell further, and the basis offer narrowed, including 09 contracts in East China-(130-180-200), 09 contracts in South China-(50-80 and + 30), 09 contracts in North China-(330-350-400) and 09 contracts in Southwest China-(250-300). Spot market today, the spot price transaction has improved, after the futures price down, the enthusiasm of hanging orders in the lower reaches has increased, there is a rigid demand for replenishment, the overall transaction atmosphere is OK.

From the perspective of futures:The night price of PVC2409 contract is the highest price at the beginning of trading, and then the price goes down. After the start of morning trading, the low price fluctuated, the overall trend of the futures price was not obvious, and the afternoon futures price further weakened slightly. 2409 contracts fluctuated in the range of 5606-5695 throughout the day, with a spread of 89. 09 contracts with an increase of 17002 positions, with 894410 positions so far, 2501 contracts closing at 5803 and 279996 positions.

PVC Future Forecast:

In terms of futures:The futures price of the PVC2409 contract fell below the track and hit a new low, the lowest point of the year in 5606, and the continuous decline in futures prices led to the deep shorting of the two markets as a whole. In terms of transactions, the short opening was 25.6% higher than that of 22.5%. Even if the futures price is running at a low level, there is a situation of short opening, which shows that the short situation of the futures price is obvious. The technical level shows that the opening of the third rail of the Bolin belt (13,13,2) is enlarged, the lower rail of the middle rail is obviously downward, and the KD line and MACD at the daily level show a dead fork trend. The continuous decline in futures prices continues to depress the confidence of the PVC industry chain, and the operation of futures prices in the short term may continue to observe the operating range of the low range of 5500-5700.

Spot aspect:From the current futures market trend, futures prices in the low position down the case, consider or a larger probability to test the integer barrier 5500. For the current spot market, the basis narrowed after the futures price fell, and the transaction improved after the price decline in the spot market today. The existence of rigid demand replenishment makes the supply digestion of the spot market slightly smooth compared with the previous period. But it is only limited to rigid demand procurement, the current price and time nodes, the industrial chain is also difficult to copy the bottom of the voice, the weak market has formed a big shackle, and the current high inventory has not been alleviated. At present, the continuous operation of the two cities is weak, the supply and demand fundamentals of the spot market are difficult to have a better guidance, and the macroeconomic policy level and information level are also lacking, so the overall PVC spot market continues to operate weakly in the short term.