PVC: Futures hot money appeared on the market to reduce positions, futures prices rose in the afternoon, and the spot market adjusted flexibly

PVC Futures Analysis:July 24 V2409 contract opening price: 5744, highest price: 5794, lowest price: 5730, position: 907516, settlement price: 5758, yesterday settlement: 5797, down 39, daily trading volume: 554866 lots, precipitated capital: 3.673 billion, capital outflow: 146 million.

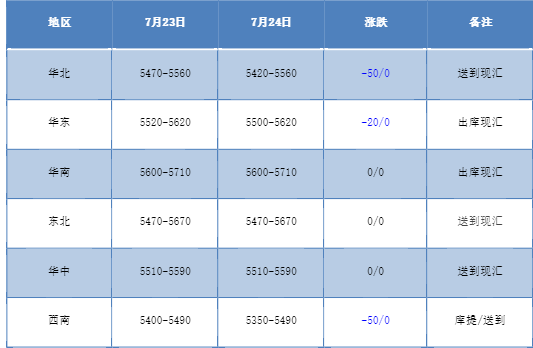

List of comprehensive prices by region: yuan / ton

PVC spot market:Domestic PVC market mainstream transaction price low small adjustment mainly, the market is weak operation. Compared with the valuation, the low end of North China fell by 50 yuan / ton, the low end of East China fell by 20 yuan / ton, South China was stable, Northeast China was stable, Central China was stable, and the low end of Southwest China fell 50 yuan / ton. The ex-factory prices of upstream PVC production enterprises began to lower their quotations mainly, and the ranges varied mostly in the range of 20-30-50 yuan / ton. the futures continued to be arranged at low levels, and the quotations of traders in the spot market decreased slightly, and it was difficult for the market to close a deal. After the futures price went down to then, the basis offer strengthened, including 09 contracts in East China and 09 contracts in South China. 09 contracts in the North-(350-450) and 09 in the Southwest-(300-400). After the sharp decline in the futures price yesterday, the spot transaction improved, but today's spot transaction has weakened, coupled with the afternoon price upward, the low hanging order did not close, so the overall trading atmosphere in the spot market is general.

From the perspective of futures:The night price of PVC2409 contract opened mainly in a narrow range, hovering in the low range. After the start of morning trading, the volatility of the futures price also did not see a clear direction, but the afternoon price rose, recovering some of the decline. 2409 contracts fluctuated from 5730 to 5794 throughout the day, with a spread of 64. 09 contracts reduced by 42934 positions, with 907516 positions so far, 2501 contracts closing at 5962, and positions of 226218 hands.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2409 contract broke away from the trend of low hovering in the afternoon, the futures price rose slightly, and recovered some of the decline in the weak market. The positions increased yesterday were reduced today, and the positions returned to the position of more than 900,000 hands. However, from the point of view of the transaction, the short opening of 21.1% was higher than that of 18.4%, and it was still relatively small in such a low situation. It can also be seen that the short positions of futures are mainly short. And in the plasticizing plate PVC and polyolefin products, the basis difference is further expanded. The technical level shows that the three-track openings of the Bolin belt (13, 13, 2) continue to be all downward, and the short positions are arranged obviously. in the short term, we will continue to observe the performance in the range of 5730-5830 during the low period.

Spot aspect:Trading in the spot market turned weak today, and after the price went down yesterday, the enthusiasm of inquiry increased, and the corresponding transaction also increased. Although the futures price is still low today, the transaction in the spot market is not good. Including the first generation of contracts and middlemen, shipments are relatively slow, and social inventory is still high. In the current plasticizing plate, the PVC single product is weak, and the futures plate is always in the role of empty distribution in the plasticizing plate, and the recent market has also been confirmed. Although there is some support in the fundamentals due to the reduction of maintenance supply, the current two cities have always performed poorly and returned to the low range to start sports finishing. In the outer disk, international crude oil futures prices continued to decline and hit a six-week low on rising expectations of a ceasefire in Gaza and concerns about Chinese demand. In addition, the strength of the dollar also puts pressure on oil prices. On the whole, in the short term, the PVC spot market will continue to be low-level consolidation.