PVC: The futures price broke downwards awkwardly, the low-end approached the low level before the main company, and the spot Formosa Plastics prices were mixed

PVC Futures Analysis:July 23rd V2409 contract opening price: 5838, highest price: 5849, lowest price: 5739, position: 950450, settlement price: 5797, yesterday settlement: 5838, down 41, daily trading volume: 817228 lots, precipitated capital: 3.819 billion, capital inflow: 103 million.

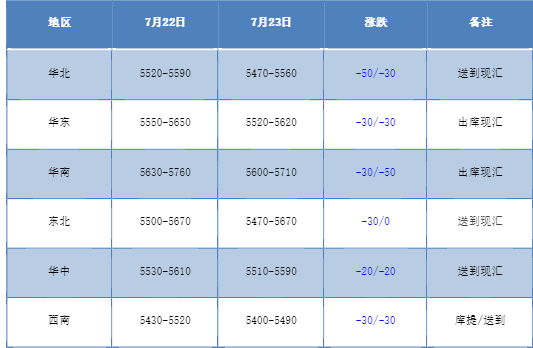

List of comprehensive prices by region: yuan / ton

PVC spot market:Domestic PVC market mainstream transaction prices continue to decline, low deep adjustment. Compared with the valuation, it fell by 30-50 yuan / ton in North China, 30 yuan / ton in East China, 30-50 yuan / ton in South China, 30 yuan / ton in Northeast China, 20 yuan / ton in Central China and 30 yuan / ton in Southwest China. There is no obvious price adjustment in the factory price of the upstream PVC production enterprises, and the cargo surface has not weakened during the bidding period in the morning, so the price adjustment of the upstream factory is not much. Futures market downward in the afternoon, the spot market trend differentiation, in the morning time merchants a mouthful price offer can still be weak, in the afternoon price down slightly, low again weak. Spot market offers coexist, including 09 contracts in East China (200-250-280), 09 contracts in South China-(100-150), 09 contracts in North China-(360-460), and 09 contracts in Southwest China-(300-400). On the whole, when the point price advantage is obvious, the spot transaction has partially improved, and the offer intention of some traders' base difference has increased slightly.

From the perspective of futures:The price of PVC2409 contract opened slightly lower in night trading, and the corresponding decline was not obvious. The futures price even rose slightly after the start of morning trading, but the afternoon low fell further, refreshing the previous low. 2409 contracts fluctuated in the range of 5739-5849 throughout the day, with a spread of 11009.09 contracts with an increase of 42214 positions, with 950450 positions so far, 2501 contracts closing at 5930 and 217351 positions.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2409 contract has appeared an awkward downward breaking mode. first of all, the low of the futures price refreshes the recent low, and it is only 20 points away from the low of 5719 of the main contract on April 8. in the more than a month from the end of the 09 contract in the current period, the trend of the futures price returns to the low range, even earlier than the premise of the main contract, which shows that the weakness of the two cities is relatively obvious. The technical level shows that the three-track openings of the Bollinger belt (13, 13, 2) are all downward, and the KD lines and MACD lines at the daily level show a dead-forked trend. The operation of the current futures price may continue to be weak, and we will continue to observe the performance in the range of 5700-5800 during the low period in the short term.

Spot aspect:When the downward trend of the futures price is relatively obvious in the afternoon, the enthusiasm of the spot market inquiry has increased, and the transaction has improved, and the demand for replenishment in the rigid demand has made the spot trading volume higher than that in the previous period, but it is only limited to the rigid demand, the speculative demand is difficult to produce better in such a weak market, the basis of the point price has narrowed, but some businesses are relatively flexible in order to stimulate the delivery basis. The monthly shipping prices for Taiwan Formosa Plastics PVC8 are as follows: Chinese mainland CFR rose $10 to $830, Southeast Asia CFR rose $40 to $875, and India CFR fell $70 to $910. On the outer disk, prices in the international crude oil futures market continued their decline and hit their lowest level in more than a month because of concerns about crude oil demand and expected oversupply. On the whole, it is difficult to change the weak operation of PVC spot market in the short term.