Daily review of urea: Poor receipts after market price cuts continue to be lowered today (July 23)

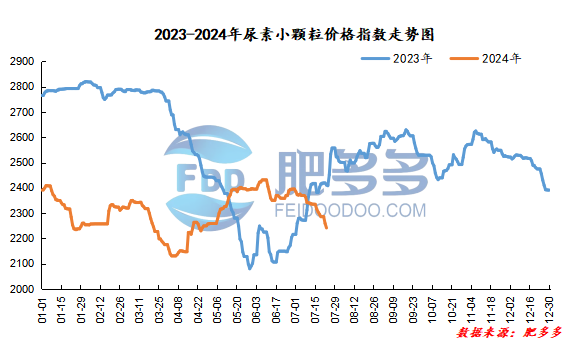

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on July 23 was 2,241.18, a decrease of 17.73 from yesterday, a month-on-month decrease of 0.78% and a year-on-year decrease of 7.04%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2006, the highest price is 2018, the lowest price is 1993, the settlement price is 2005, the closing price is 21% lower than the settlement price of the previous trading day, down 1.04% month-on-month, and the fluctuation range throughout the day is 1993-2018; the basis of the 09 contract in Shandong is 195; the 09 contract has reduced its position by 3036 lots today, and its position is 162037 lots so far.

Today, urea futures prices opened low and went low, continuing their weak operation, and once fell below the 2000 yuan mark. On the one hand, the overall sentiment of the domestic financial market was frustrated due to market rumors that the policy side was unable to provide large-scale stimulus measures in the short term. On the other hand, the fundamentals of weak supply and demand for urea itself are still the main logic. Urea prices lack actual drivers and may still remain weak in the short term.

Spot market analysis:

Today, the domestic urea market price continued to decline. After the company's quotation was lowered, the follow-up of new orders did not increase, but the waiting list was gradually reduced. Today's quotation continued to be lowered, and more attention was paid to the low-end market transactions in the future.

Specifically, prices in Northeast China fell to 2,230 - 2,260 yuan/ton. Prices in East China fell to 2,150 - 2,210 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,150 - 2,350 yuan/ton, and the price of large particles fell to 2,180 - 2,210 yuan/ton. Prices in North China fell to 2,030 - 2,290 yuan/ton. Prices in South China fell to 2,270 - 2,360 yuan/ton. Prices in the northwest region are stable at 2,350 - 2,380 yuan/ton. Prices in Southwest China are stable at 2,180 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers are about to reduce their sales, follow-up on new orders is not good, shipments are under pressure, offers continue to be lowered and orders are attracted, transactions have improved after price cuts in some regions, and overall follow-up is limited, making it difficult to support high prices. In terms of the market, market prices continue to decline, but demand is weak, follow-up of new orders is not good, market trading atmosphere is sluggish, purchasing atmosphere continues to be light, and the market lacks good support in the short term, and there is still room for decline. On the supply side, new equipment in the industry has been put into production, and early maintenance equipment has continued to be restored. Nissan has steadily increased, and the supply side has been sufficient for a short period of time. On the demand side, the demand side continues to remain weak and follow-up. Downstream is cautious in taking goods and is willing to take goods on a low level. It is more important to maintain a phased basis and just need to take a small amount of goods, with a wait-and-see mentality.

On the whole, the current supply and demand fundamentals in the urea market are weak, prices remain high and lack obvious positive news support, and the market is weak and falling. It is expected that urea market prices will continue to decline in a short period of time, and companies will cut prices and collect orders.