PVC: When will the low futures price break, what to do to save the big V, and the spot weakness remains

PVC Futures Analysis:July 22nd V2409 contract opening price: 5835, highest price: 5877, lowest price: 5797, position: 908236, settlement price: 5838, yesterday settlement: 5847, down 9, daily trading volume: 681684 lots, precipitated capital: 3.743 billion, capital outflow: 3.44 million.

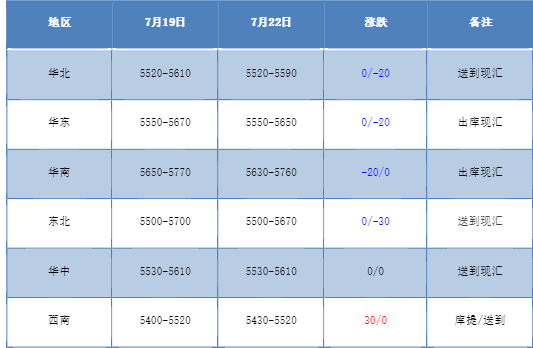

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of the domestic PVC market is weak, and the adjustment trend of the spot market is insufficient. Compared with the valuation, it fell by 20 yuan / ton in North China, 20 yuan / ton in East China, 20 yuan / ton in South China, 30 yuan / ton in Northeast China, stable in Central China, and 30 yuan / ton in Southwest China. Upstream PVC production enterprises mostly maintain stable quotations, but today's generation of contracts are not many, businesses more wait-and-see heart. Futures narrow adjustment, slightly weaker low, the spot market offer price slightly lower than last Friday, but the basis offer advantage is relatively obvious, a price reference significance, including East China basis offer 09 contract-(200-250-300), South China 09 contract-(100-150), North 09 contract-(360-440), Southwest 09 contract-(300-400). The base gap in the northern and southwestern regions has narrowed obviously. On the whole, it is difficult to close a deal at a high price in the spot market. At the beginning of the week, the enthusiasm for picking up goods downstream is not high, and the turnover in the spot market is light.

From the perspective of futures:PVC2409 contract night trading price opening small shock adjustment, the volatility of the price is lack of direction. Prices fell after the start of early trading on Monday, but bottomed out at the lowest point, rising again to recover the decline, and even the high surpassed the night trading and adjusted narrowly in the afternoon. 2409 contracts range from 5797 to 5877 throughout the day, with a spread of 80,009 and a reduction of 8057 positions, with 908236 positions so far, 2501 contracts closing at 6029 and 200217 positions.

PVC Future Forecast:

In terms of futures:The operating volatility of the futures price of the PVC2409 contract has expanded. Compared with last Friday, the short opening of the transaction was 23.2% higher than the opening of 22.2%, and the market showed a slight reduction in positions. The operation of the futures price shows a cross star positive column, and there is no obvious change in the low narrow horizontal plate of the iterative futures price last week. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) narrows obviously, and the daily level MACD line continues to show a dead fork trend. At present, from the technical level, the fluctuation of the futures price is lack of direction, and the trend from the PVC fundamentals is not enough to cause the fluctuation of the futures price to change greatly. Therefore, in the short term, we think that the operation of futures prices may continue to observe the performance of the range of 5800-5950 during the low period.

Spot aspect:At the beginning of the week, the adjustment of the two cities is not enough to produce direction, it comes from the lack of fundamentals, and the volatility of the futures disk price is also narrow and horizontal, so the adjustment range of the two cities in the near future is not much, basically weak. In terms of PVC supply, the PVC plant is still overhauled recently, and the supply of low starting load has been reduced, but the demand constraints have a more far-reaching impact on the prices of the two cities, so the fundamentals of PVC under the game between supply and demand are weak, the comprehensive profits of chlor-alkali enterprises are basically maintained by caustic soda, and the calcium carbide in the upper reaches of the PVC industry chain is also at a loss, while the starting load of downstream PVC products enterprises is low. It is difficult to make a big change in the frequency and pace of PVC procurement. At present, there is less guidance from the policy news side, the PVC spot market may continue to adjust narrowly in the short term, and the price adjustment is waiting for a turn for the better.