Daily Review of Urea: Poor follow-up on new orders in the market and obvious accumulation of enterprises (July 18)

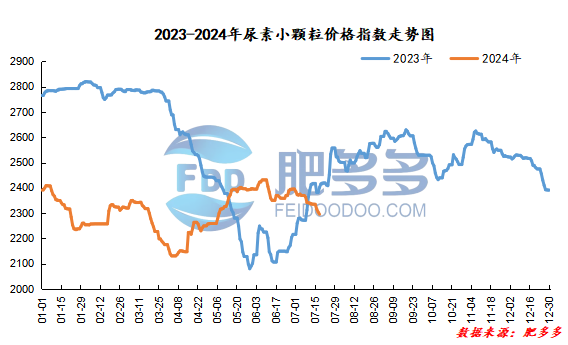

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on July 18 was 2,295.27, a decrease of 8.64 from yesterday, a month-on-month decrease of 0.37% and a year-on-year decrease of 4.42%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2034, the highest price is 2040, the lowest price is 2020, the settlement price is 2030, and the closing price is 2039. The closing price is 44 lower than the settlement price of the previous trading day, down 0.20% month-on-month. The fluctuation range of the whole day is 2020-2040; the basis of the 09 contract in Shandong is 221; the 09 contract has reduced its position by 5625 lots today, and so far, it has held 171259 lots.

Urea futures prices remained mainly weak and volatile today, and rebounded slightly in the afternoon with the market environment. The current urea trading logic may still operate around the expectation of weakening its own fundamentals, but its own low inventory status also provides certain support for prices. The mentality of downstream industrial procurement in the short term is still relatively cautious. It can be observed whether the follow-up situation of agricultural demand has improved after the weather disturbance. Before that, the urea market may remain weak and volatile.

Spot market analysis:

Today, the domestic urea market price continued to be weak and lowered. Market demand followed up with a small amount of low prices, and price support was weak. Enterprises had accumulated inventories, shipments continued to be under pressure, and continued to cut prices and collect orders.

Specifically, prices in Northeast China have stabilized at 2,260 - 2,300 yuan/ton. Prices in East China fell to 2,230 - 2,290 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,210 - 2,380 yuan/ton, and the price of large particles fell to 2,210 - 2,240 yuan/ton. Prices in North China fell to 2,110 - 2,330 yuan/ton. Prices in South China fell to 2,300 - 2,400 yuan/ton. Prices in Northwest China fell to 2,350 - 2,380 yuan/ton. Prices in Southwest China are stable at 2,200 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, after manufacturers 'quotations have been lowered for several consecutive days, the overall receipts have remained average, and the situation has not improved. Some low-end quotations have been traded well, shipments continue to be under pressure, quotations have continued to stabilize slightly, making it difficult to move upwards. In terms of the market, the market continues to operate in a weak and stable manner, with many transactions being sold at low prices. The overall trading atmosphere is average. Companies entering the market are less enthusiastic and have a cautious mentality. In the short term, the market will continue to be weak and mainly consolidated. In terms of supply, early maintenance equipment has been resumed one after another, and equipment is still stopped for maintenance within the week. The industry's daily production range has been consolidated and maintained at a high level of 180,000 tons. This week, corporate inventories have accumulated, shipments are under pressure, and supply pressure has become prominent. In terms of demand, the operating rate of compound fertilizers has increased slightly compared with the previous period, and the demand for raw materials has increased. However, follow-up is relatively scattered. Most small orders have been maintained to follow up on purchases. The transaction price has dropped, and the purchasing mentality has been cautious.

On the whole, most of the current urea market transactions are at the low-end, with weak demand support and poor market sales. It is expected that the urea market price will continue to operate weakly and steadily in the short term.