PVC: Futures prices rose to recover part of their decline, short orders were profit-taken, and spot prices were tentatively reported higher

PVC Futures Analysis:July 17 V2409 contract opening price: 5840, highest price: 5903, lowest price: 5833, position: 904052, settlement price: 5873, yesterday settlement: 5821, up 52, daily trading volume: 722376 lots, precipitated capital: 3.725 billion, capital outflow: 831.2 billion.

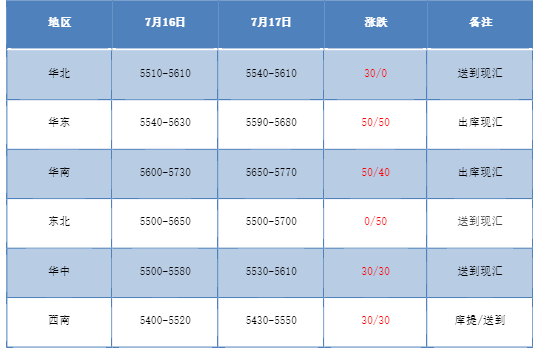

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of the domestic PVC market has increased slightly, and the market atmosphere has not changed. Compared with the valuation, North China rose 30 yuan / ton, East China 50 yuan / ton, South China 40-50 yuan / ton, Northeast China 50 yuan / ton, Central China 30 yuan / ton, and Southwest China 30 yuan / ton. The ex-factory prices of upstream PVC production enterprises have been increased by 30-40 yuan / ton individually, and the quotations of most enterprises have remained stable, and the signing of contracts is mainly based on basic quantity. The futures price rose slightly to recover some of the decline, and the spot market quotation rose slightly, but the feedback from the lower reaches to the revised quotation was mediocre, the spot market point price and the spot market price coexisted, and the spread of the spot price was not adjusted much today. among them, East China basis offer 09 contract-(200-250), South China 09 contract-(100-150), North 09 contract-(380-450), Southwest 09 contract-(400-450). After today's futures prices in the two markets, trading in the spot market has weakened, and the downstream hanging order point is still generally low, so the spot market transaction is not good.

From the perspective of futures:The night price of PVC2409 contract rose slightly after the opening shock, and the low price has been repaired. After the start of morning trading, the futures price fluctuated on the basis of the night high, and there was no obvious change in the afternoon price. 2409 contracts fluctuate from 5833 to 5903 throughout the day, with a spread of 70,009 and a reduction of 26657 positions, with 904052 positions so far, 2501 contracts closing at 6079 and 183166 positions.

PVC Future Forecast:

In terms of futures:The operation of the futures price of the PVC2409 contract rose slightly, and the market showed a slight reduction in positions. in terms of transaction, it was 27.1% flat compared to 22.7% higher. The rising futures price of the empty contract is more inclined to consider the profit settlement of the short order and wait and see for the time being. At the technical level, it shows that the three-track openings of the Bolin belt (13, 13, 2) are all downward, and the disk surface still shows a certain partial air situation, the KD line at the daily line level is not strong at present, and the MACD line continues to show a dead fork trend. At present, although the operation of the futures price is still relatively narrow, the departure of the short order has curbed the further decline of the futures price to a certain extent. in the short term, the operating observation range of the futures price is in the range of 5820-5950.

Spot aspect:The upward price of the two markets did not lead to an improvement in trading, but trading turned light when the hanging point was generally low. at present, in terms of PVC fundamentals, calcium carbide cost port calcium carbide price has been sporadically adjusted during the week, low-end price decreased, PVC start load slightly increased with the end of maintenance, demand is still nothing new, basically based on pre-order production, and then maintain the frequency of procurement PVC At present, the fundamentals of PVC are difficult to support large fluctuations in the prices of the two markets. In the outer disk, the price of the international crude oil futures market continued to fall, the stronger US dollar continued to drag on the decline in oil prices, the market continued to pay attention to the impact of the downturn in economic data on global oil demand, and the decline in China's crude oil imports also put pressure on oil prices. On the whole, the PVC spot market will continue to maintain a small adjustment model in the short term.