Daily Review of Urea: There is no good market to support companies to continue to reduce prices and collect orders (July 17)

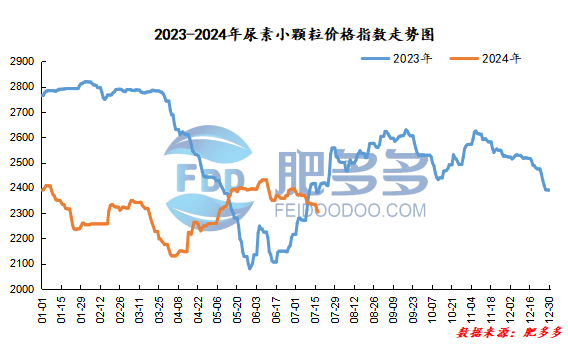

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on July 17 was 2,303.91, a decrease of 12.00 from yesterday, a month-on-month decrease of 0.52% and a year-on-year decrease of 3.25%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2056, the highest price is 2065, the lowest price is 2027, the settlement price is 2043, and the closing price is 2035. The closing price is 9 lower than the settlement price of the previous trading day, down 0.44% month-on-month, and the fluctuation range throughout the day is 2027-2065; the basis of the 09 contract in Shandong is 235; the 09 contract has reduced its position by 2453 lots today, and so far, the position is 176884 lots.

Today, urea futures prices fluctuated mainly downward. On the one hand, the overall sentiment in the commodity market is weak today. Important domestic meetings are coming to an end but policy guidance has not yet been issued. Market rush trading expectations have failed. On the other hand, the expectation of weakening the fundamentals of urea itself is verified by the accelerated accumulation of inventories. The subsequent urea market is not influenced by external factors or is still operating around its own weak logic of expected supply increase and demand decrease.

Spot market analysis:

Today, the domestic urea market price continues to decline, and companies are gradually reducing their orders. The pressure on acquiring orders is gradually emerging. Orders continue to be lowered. Coupled with the current high market supply and poor follow-up demand, prices have mostly shown a weak downward trend.

Specifically, prices in Northeast China fell to 2,260 - 2,300 yuan/ton. Prices in East China fell to 2,250 - 2,300 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,230 - 2,420 yuan/ton, and the price of large particles stabilized at 2,250 - 2,280 yuan/ton. Prices in North China fell to 2,110 - 2,330 yuan/ton. Prices in South China have stabilized at 2,320 - 2,410 yuan/ton. Prices in the northwest region are stable at 2,380 - 2,400 yuan/ton. Prices in Southwest China are stable at 2,200 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have followed up on a small number of new orders, which has limited support for the market. Currently, they continue to ship orders received in advance in the early stage, and the number of waiting orders is gradually reduced. The shipping pressure has increased significantly. Companies continue to reduce prices based on the number of remaining orders. In terms of the market, market prices continue to decline, but the activity of new orders is not high, the sentiment fluctuates downward, the market is weak, stable and deadlocked, and the trading atmosphere continues to be dominated by wait-and-see. On the supply side, the supply side is still slowly recovering. The industry's operating rate has increased. Some planned maintenance equipment has been postponed, and the maintenance time has yet to be determined. The current industry's capacity utilization rate continues to remain at a high level of more than 80%, providing sufficient supply. On the demand side, the market's demand for procurement is regional, and demand follow-up is relatively scattered. There has not been a large-scale follow-up and replenishment of orders yet. The purchasing mentality of the industry is wait-and-see, and short-term demand support is limited.

On the whole, there is no obvious positive support in the urea market at present, and there is a limited amount of market demand to follow up. Operators are on a wait-and-see attitude, and companies cut prices and collect orders. It is expected that the urea market price will continue to test and collect orders in a short period of time.