Daily Review of Urea: Flexible consolidation of corporate quotations at low prices in the market (July 16)

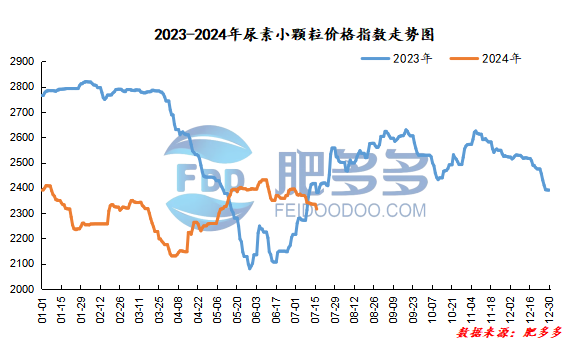

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on July 16 was 2,315.91, a decrease of 16.95 from yesterday, a month-on-month decrease of 0.73% and a year-on-year decrease of 2.77%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2046, the highest price is 2055, the lowest price is 2032, the settlement price is 2044, and the closing price is 2042. The closing price is 25% lower than the settlement price of the previous trading day, down 1.21% month-on-month. The fluctuation range of the whole day is 2032-2055; the basis of the 09 contract in Shandong is 238; the 09 contract has increased its positions by 11 lots today, and so far, it has held 179337 lots.

Today, urea futures prices remained mainly weak and volatile, with relatively limited intraday fluctuations. The expectation of weak fundamentals of urea itself is still the main logic of the market, but its own absolute low inventory forms a certain support for prices. If there is a recurrence between supply and demand, the expectation of price elasticity still exists. In the short term, urea may still develop in a stable state. Weak shocks are the main ones.

Spot market analysis:

Today, the follow-up situation of low-end goods in the domestic urea market is relatively good, downstream purchasing mentality is relatively cautious, overall demand-side purchasing is not enough to support the market rise, price upward is blocked, and manufacturers 'quotations are flexibly organized。

Specifically, prices in Northeast China fell to 2,290 - 2,340 yuan/ton. Prices in East China fell to 2,250 - 2,310 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,240 - 2,450 yuan/ton, and the price of large particles has stabilized at 2,250 - 2,280 yuan/ton. Prices in North China fell to 2,110 - 2,380 yuan/ton. Prices in South China fell to 2,320 - 2,410 yuan/ton. Prices in the northwest region are stable at 2,380 - 2,400 yuan/ton. Prices in Southwest China fell to 2,200 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have better orders from low-end sources, and sales pressure has been slightly relieved. They continue to reduce prices and collect orders, flexibly adjust prices based on their own orders, and have a cautious mentality. In terms of the market, transactions at the low-end of the market have improved. Most players are making up orders at low prices, but they are weak in following up on high prices. They are cautious. The current market lacks good support for continued upward movement. For the time being, the market is mainly dominated by stalemate and fluctuations, and there is insufficient motivation for continued price rise. On the supply side, Nissan continues to rebound, market supply continues to increase, and price increases are blocked. On the demand side, there is still a certain demand for industry and agriculture in the market. The northern region is following up on topdressing, the autumn fertilizer production time of downstream compound fertilizer factories is approaching, and the small amount of stock is limited, so most of the goods are followed up on demand. The mentality of getting goods is cautious, and the overall support is weak. There has not been a centralized procurement phenomenon, and most of the follow-up is mainly phased replenishment.

On the whole, the current demand for urea has followed up, but the purchase of small quantities is limited, and the market has many goods at low prices. There is insufficient support for the market. It is expected that the urea market price will be stable and tentatively lowered in a short period of time.