Daily Review of Urea: Low-end goods in the market are better, companies offer different offers (July 10)

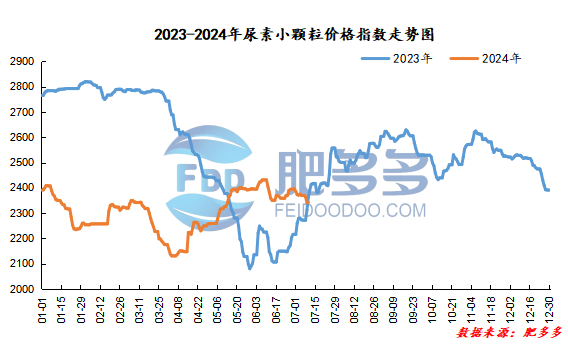

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on July 10 was 2,340.14, a decrease of 1.36 from yesterday, a month-on-month decrease of 0.06% and a year-on-year decrease of 0.99%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2077, the highest price is 2080, the lowest price is 2050, the settlement price is 2061, and the closing price is 40% lower than the settlement price of the previous trading day, down 1.91% month-on-month. The fluctuation range throughout the day is 2050-2080; the basis of the 09 contract in Shandong is 235; the 09 contract has reduced its position by 8817 lots today, and the position held so far is 185561 lots.

Today, urea futures prices mainly opened lower and moved lower with the market environment. On the one hand, the month-on-month weakening of domestic CPI data in June led to a higher level of domestic real interest rates, putting further pressure on the economic environment. On the other hand, urea's own fundamentals maintain a weak expected logic of increasing supply and decreasing demand, and the month-on-month growth in inventory data during the week has also been verified. However, the absolute level of inventory is still low, which still has some support for prices, and there is no new drive in the short term. Before the emergence of the urea market may still operate around its own expected weakening logic.

Spot market analysis:

Today, domestic ureamarketPrices were mixed. After sellers 'prices were lowered, the follow-up situation of low-end supply in the market was better, and companies were waiting to accumulate. Some quotations were stable and slightly increased today.

Specifically, prices in Northeast China have stabilized at 2,350 - 2,400 yuan/ton. Prices in East China rose to 2,270 - 2,320 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,240 - 2,450 yuan/ton, and the price of large particles rose to 2,260 - 2,280 yuan/ton. Prices in North China fell to 2,150 - 2,420 yuan/ton. Prices in South China fell to 2,350 - 2,420 yuan/ton. Prices in the northwest region are stable at 2,380 - 2,400 yuan/ton. Prices in Southwest China fell to 2,220 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, after the manufacturers lowered their offers, transactions with low-end sources of goods improved, and transactions with new orders increased significantly. Some companies have a better situation in receiving new orders, and some have stopped collecting. The company's early sales pressure has eased, and orders to be issued have accumulated., showing a strong and small increase in the short term. In terms of the market, the market was volatile and consolidated. Market prices continued to decline this week. The purchase of low-priced goods was better. The transaction of new orders in the market improved, which provided support for the market in the short term. However, the support was limited, and the market was in a stalemate. On the supply side, maintenance companies have recovered one after another, Nissan has increased in a narrow range, and supply has gradually increased. On the demand side, in the off-season of agricultural demand, industrial demand is connected. Downstream operators appropriately enter the market to purchase, most of which need to buy just now, and the demand is mainly followed up by sporadic and small orders.

On the whole, the current supply-demand relationship in the urea market is still loose, with a certain amount of follow-up demand in the short term, but the support for the market is weak. It is expected that the urea market price will rise slightly in a short period of time and then stabilize.