Methanol: The mainland market is strong and the port spot is weak

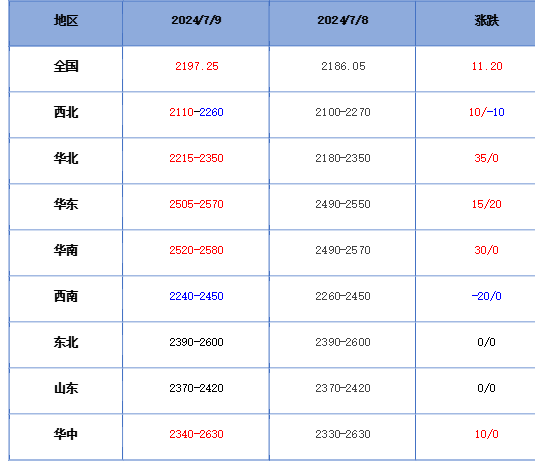

On July 9, the methanol market price index was 2197.25, up 11.2% from yesterday and 0.51% higher than the previous month.

Outer disk dynamics:

Methanol closed on July 8:

China CFR 287-290 US dollars / ton, down 2 US dollars / ton

Us FOB 106-107 cents per gallon, down 1 cent per gallon

Us $353-354 per ton in Southeast Asia, Ping

European FOB 322.75-323.75 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2240-2260 (- 10), North Route: 2110-2130 (10), Lunan: 2380-2390 (0), Henan: 2340-2355 (10), Shanxi: 2215-2300 (35), Port: 25052520 (15)

Freight:

North Route-North Shandong 250-290 (0ram 0), North Line-South Shandong 300-330 (0max 0), South Line-North Shandong 240-270 (0ax 0), Guanzhong-Southwest Shandong 140-180 (0max 0)

Spot marketToday, methanol market prices are adjusted in a narrow range, and most mainland enterprises' quotations operate firmly under the support of little inventory pressure, and the overall trading atmosphere of the market is OK, and then the port spot quotation runs weakly, although the futures market is slightly higher, but the inventory in the port area remains high, and the market negotiation atmosphere is general. Specifically, the market prices in the main producing areas are adjusted in a narrow range, with the quotation on the southern route around 2120 yuan / ton, stable, and the quotation on the northern line around 2110-2130 yuan / ton, with a low-end increase of 10 yuan / ton, and the futures market fluctuates upwards, forming a certain support for the mentality of the operators in the market. and at present, the inventory level of most enterprises is not high, and there is some support for the mentality of manufacturers. The market price of Shandong, the main consumer, is raised narrowly, southern Shandong 2380-2390 yuan / ton, low-end stable, high-end 10 yuan / ton, northern Shandong 2380-2400 yuan / ton, most of the downstream raw material inventory is high, purchasing enthusiasm is not good. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2300-2380 yuan / ton today, the low end is stable, the downstream demand is limited, more low prices and a small amount of inquiry are given priority to, and the market transaction atmosphere is limited; Shanxi quotes 2215-2300 yuan / ton today, 35 yuan / ton higher than yesterday, the overall supply pressure in the region is not great, the market atmosphere is boosted, and the quotation of manufacturers is raised in a narrow range.

Port marketToday, methanol futures fluctuate in a narrow range. Every high shipment in recent months, rigid demand replenishment, basis stabilized; long-term arbitrage buying increased, replacement ideas continued, 7 big 8 price spread slightly expanded, the basis is strong. There was a stalemate in the afternoon and the deal was all right. Taicang main port transaction price: spot / 7: 2505-2515, basis 09-35 + 7: 2525, basis 09-27 + 7: 2535, basis 09-10 + 8: 2560, basis 09-15 + 18.

Future forecast:Recently, the market price of methanol is stronger in the mainland and weaker in the port, and the quotation in the mainland market remains high under the support of low inventory, and there are still plans for parking in some units in the later stage, and the market supply in the region has been reduced. it forms a certain support to the market price in the producing area, and the price-up sentiment of the manufacturers is obvious. From the port market point of view, the current port market inventory is still in a state of accumulation, with the arrival of imported shipments and downstream demand has not yet recovered under the influence of short-term port regional supply may still be abundant. At present, the traditional downstream market is in the off-season of consumption, and there is no plan to restart the olefin plant for the time being. under the influence of weak demand, the mindset of market operators is poor, and the downstream and traders are mainly cautious and rigid demand operation. It is expected that the short-term methanol market price will continue the range fluctuation trend, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.