PVC: Futures price fluctuations narrowed, hot money briefly left the market to reduce positions, and the spot market adjusted slightly

PVC Futures Analysis:July 9 V2409 contract opening price: 5955, highest price: 5994, lowest price: 5952, position: 903161, settlement price: 5975, yesterday settlement: 5970, up 5, daily trading volume: 614132 lots, precipitated capital: 3.777 billion, capital outflow: 132 million.

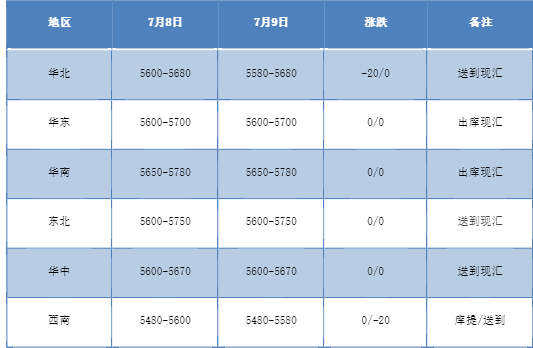

List of comprehensive prices by region: yuan / ton

PVC spot market:The domestic PVC market mainly deals with narrow range, while the spot market adjusts flexibly. Compared with the valuation, the low end of North China fell by 20 yuan / ton, East China was stable, South China was stable, Northeast China was stable, Central China was stable, and the high end of Southwest China fell 20 yuan / ton. After the continuous reduction of the ex-factory price of the upstream PVC production enterprises, today's offer is mainly stable, but there are not many contracts signed, and some orders are delayed. The futures market is low, the spot market is weak, and both the spot price and the spot price coexist, but the current fluctuation range of the futures price is relatively obvious, and the basis is slightly adjusted in various regions, including 09 contracts in East China-(280-350), South China 09 contracts-(180-250), North 09 contracts-(450-550), Southwest 09 contracts-(400-480). Although the spot market offer flexible adjustment, but today did not lead to a better deal, downstream procurement enthusiasm is general, spot transaction is weak, the actual single part of the negotiation.

From the perspective of futures:The opening price of PVC2409 contract night trading showed a good upward trend, bottoming out and rebounding. After the start of morning trading, it fell slightly from the high point, and the afternoon price was mainly arranged in a narrow range, and the overall fluctuation range of the market during the day narrowed. 2409 contracts fluctuated from 5952 to 5994 throughout the day, with a spread of 42 and 09 contracts with an increase of 34953 positions, with 903161 positions so far, 2501 contracts closing at 6140 and 139674 positions.

PVC Future Forecast:

In terms of futures:The trend of PVC2409 contract futures prices has bottomed out in the night market, but the price fluctuation range is small. Although the time-sharing night market rose well in a single day, only 42 points still lack enough clear fluctuation direction. The low point of the futures price is still in the lower track position of the Bollinger Belt, and the technical level shows that the three-track openings of the Bollinger Belt (13, 13, 2) are still all downward, and the short positions are arranged obviously. in terms of transaction, the opening is 21.1% higher than the short opening 20.1%, and the disk shows that there are departures in both positions and short positions, of which 25.4% are flat compared to 25.9%. At present, the fluctuation of the futures price may still be low, and the performance of the low range of 5930-6020 will be observed in the short term.

Spot aspect:Today's spot market turnover is general, in yesterday's decline after the point transaction replenishment, so today's spot market trading weakening, product enterprises wait and see. After the futures price falls below the six-word prefix, the confidence of the overall industrial chain is frustrated, and it is expected to decrease from the current time node. On the supply and demand side, there is still no obvious new idea, the demand of product enterprises is low, and the starting load of production enterprises is high. And with the passage of time, the performance of 09 contracts continues to be weak, the spot market is difficult to show a better transaction, high inventory has always been restricted. In the outer disk, international oil prices closed low, hitting an one-week low, as Hurricane Beryl closed oil refineries and ports along the Gulf Coast of the United States, and the market hoped that a possible ceasefire agreement in Gaza would ease concerns about disruptions to global crude oil supplies. On the whole, the market lacks sufficient guidance and stimulation in the short term, and it is still dominated by low-level consolidation.