Daily Review of Urea: Market supply is tight and demand is weak. Market operation is deadlocked (July 1)

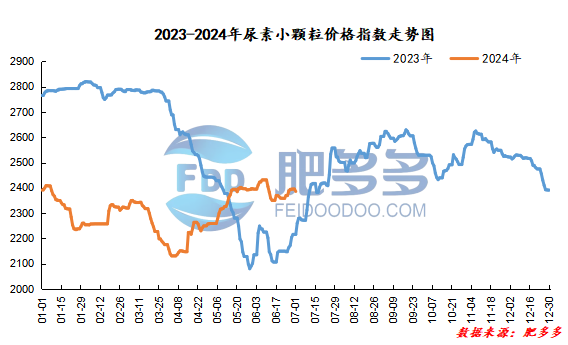

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on July 1 was 2,385.59, a decrease of 9.55 from last Friday, a month-on-month decrease of 0.40% and a year-on-year increase of 7.67%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2123, the highest price is 2125, the lowest price is 2076, the settlement price is 2093, and the closing price is 2095. The closing price is 45 lower than the settlement price of the previous trading day, down 2.10% month-on-month. The fluctuation range of the whole day is 2076-2125; the basis of the 09 contract in Shandong is 205; the 09 contract has reduced its position by 5451 lots today, and so far, it has held 204129 lots.

Today, urea futures prices gapped lower and opened lower, and the overall operation was weak. The fundamentals of urea itself are still centered around the game of increasing supply and reducing demand. The market sentiment driven by last week's printing news has gradually subsided. Due to the continued weakening of the speculative atmosphere due to the characteristics of the variety, combined with weak spot market demand over the weekend, the overall urea futures price is running weak.

Spot market analysis:

Today, domestic ureamarketPrices remained stable and fell slightly. Last week, as the quotation gradually rose, the market's willingness to trade began to decline. New acquisitions of companies decreased, and the quotation fell slightly.

Specifically, prices in Northeast China have stabilized at 2,470 - 2,490 yuan/ton. Prices in East China fell to 2,280 - 2,340 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,260 - 2,460 yuan/ton, and the price of large particles fell to 2,260 - 2,320 yuan/ton. Prices in North China fell to 2,190 - 2,500 yuan/ton. Prices in South China fell to 2,360 - 2,460 yuan/ton. Prices in the northwest region are stable at 2,410 - 2,430 yuan/ton. Prices in Southwest China have stabilized at 2,260 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have received a large number of orders, accumulated pending orders, continued to maintain high offers, low willingness to adjust prices, short-term market observation and pricing, and execution is in progress. On the market side, after prices rose last week, the transaction of new orders in the market slowed down, and operators became cautious in following up with high prices. The market was mainly in deadlock and consolidation, with short-term consolidation. In terms of supply, equipment failures occur frequently in the industry. During parking maintenance, market supply weakens. In addition, companies continue to go to the warehouse, and inventories remain low. Market supplies are difficult to find, and supply is tight. On the demand side, the current market price is high, and downstream industry operators are afraid of high prices, so follow-up is suspended. The demand for agriculture in Northeast China is in progress. There is a demand for topdressing and fertilizer preparation in other peripheral areas, so a small amount of follow-up is mainly maintained.

On the whole, under the support of urea companies and low supply, market prices are high and demand is slow to follow up. It is expected that urea market prices will continue to stabilize and consolidate downward in a short period of time.