Urea Daily Review: Companies with limited domestic participation in the printing and labeling industry have a rational attitude and wait and see (June 27)

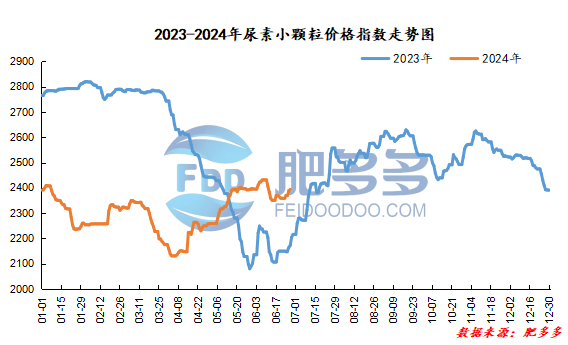

Domestic urea price index:

According to calculations from Feiduo data, the urea small pellet price index on June 27 was 2,393.77, an increase of 6.36 from yesterday, a month-on-month increase of 0.27% and a year-on-year increase of 10.21%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2133, the highest price is 2153, the lowest price is 2126, the settlement price is 2140, and the closing price is 2134. Compared with the settlement price of the previous trading day, the month-on-month increase is 0.09%. The fluctuation range of the whole day is 2126-2153; the basis of the 09 contract in Shandong is 206; the 09 contract has increased its position by 1103 lots today, and so far, it has held 215959 lots.

Today, the overall urea futures price fluctuated mainly within a narrow range. The early stamp and macro sentiment support subsided, and the actual upward drive of disk prices was limited. However, in the short term, the fundamentals of urea itself are relatively stable, and international prices have also formed certain support for the country. In the short term, we still need to pay attention to how the market macro sentiment is interpreted before the important meeting in July.

Spot market analysis:

Today, domestic ureamarketPrices continue to rise, corporate quotations are mostly stable and slightly rising, the market is operating relatively firmly, and the industry is mainly based on a rational wait-and-see mentality.

Specifically, prices in Northeast China have stabilized at 2,470 - 2,490 yuan/ton. Prices in East China rose to 2,290 - 2,380 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,290 - 2,460 yuan/ton, and the price of large particles rose to 2,260 - 2,320 yuan/ton. Prices in North China rose to 2,190 - 2,500 yuan/ton. Prices in South China rose to 2,380 - 2,470 yuan/ton. Prices in the northwest region are stable at 2,410 - 2,430 yuan/ton. Prices in Southwest China have stabilized at 2,260 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories,After the manufacturer's quotation was raised, the follow-up of new orders has slowed down. The current main execution is underway, and the mentality is firm. We must look at the market and adjust the price.。In terms of market, this markingDomestic participation is limited, and the bullish mentality of industry operators has gradually returned to rationality. The positive impact of the printed label on boosting the market has gradually faded. The market trading atmosphere has returned to weakness, and the transaction of new orders has slowed down. However, the current market is still operating firmly and in a narrow range. Strong shocks。On the supply side,Nissan's recovery is slow, coupled with the current low corporate inventories, and short-term positive supply supports high prices and stability.。On the demand side,In the off-season of agricultural fertilizers, procurement has been gradually reduced. At present, agricultural demand is mainly concentrated on a small amount of corn fertilizers. Procurement on the demand side is relatively scattered, and follow-up efforts are limited; the operating rate of industrial compound fertilizers continues to decline, and the procurement of raw materials has been suspended. The overall demand side is high and needs to be followed up, and new orders are relatively cautious.。

Overall, the current urea market trading is flat, industry operators are cautious in viewing the market, and the market is temporarily stable and consolidated. It is expected that the urea market price will remain stable and slightly consolidated in the short term.