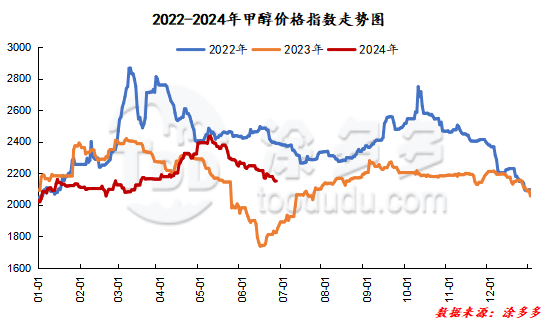

Methanol: Port inventories have increased significantly. The methanol period continues to be weak and volatile

On June 26th, the methanol market price index was 2148.95, down 1.48 from yesterday and 0.07 per cent from the previous month.

Outer disk dynamics:

Methanol closed on June 25:

China CFR 290-298 US dollars / ton, up 2 US dollars / ton

Us FOB 110111cents / gallon, down 1 cent / gallon

Us $357-358 per ton in Southeast Asia, Ping

European FOB 319.75-320.75 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2220-2270 (0), North Route: 2040-2080 (0), Lunan: 2380 (0), Henan: 2310-2335 (- 10), Shanxi: 2200-2290 (0), Port: 2505-2520 (10)

Freight:

North Route-North Shandong 240-270 (10am 0), North Line-South Shandong 330-370 (0ram 0), South Line-North Shandong 210-260 (- 20 amp Mui 10), Guanzhong-Southwest Shandong 150-190 (- 10 Compay 10)

Spot marketToday, the price of methanol spot market continues to be weak, the contradiction between supply and demand in the mainland market is still not significantly improved, the overall trading volume is limited, the futures market continues the trend of low volatility, the basis is slightly strong, and the trading atmosphere in the port spot market is limited. Specifically, the market prices in the main producing areas are arranged in a narrow range, with the quotation on the southern line around 2060 yuan / ton and the northern line around 2040-2080 yuan / ton, maintaining yesterday's market supply in the region has increased with the restart of the previous maintenance equipment. in addition, the current downstream market demand is difficult to significantly improve, the market turnover is limited. The market prices in Shandong, the main consumer area, are adjusted in a narrow range, with 2380 yuan / ton in southern Shandong and 2350-2380 yuan / ton in northern Shandong. The futures market continues to run weakly, and most operators in the market still have a certain wait-and-see mood towards the future, and the market transaction atmosphere is not good. North China market quotation narrow adjustment, Hebei quotation 2310-2350 yuan / ton today, maintained yesterday, due to poor market transactions in the surrounding areas, the impact of a slight drop in enterprise quotations, the formation of drag on the regional manufacturers' quotations, the market trading atmosphere is slightly light, Shanxi quotes today 2200-2290 yuan / ton, downstream terminal demand has not significantly improved, the fundamentals are lack of positive, market prices are weak.

Port marketToday, methanol futures fluctuate in a narrow range. Spot purchase on demand. The part of paper goods is shipped at a high price, and the rigid demand within the month is followed by the right price, and the basis is strong; the fluctuation in the far month is small, the goods are exchanged frequently in far and near months, and the difference between months is narrowed. The overall deal is OK. Taicang main port transaction price: spot / 6: 2505-2520, basis 09: 8, margin: 2505: 2515, margin: 09: 6, margin: 10: 7, transaction price: 2515-2525, basis: 09: 17: 20, transaction price: 2530-2535, margin: 09: 30.

Future forecast:At present, the mainland market is still in a situation where supply exceeds demand. The mentality of most manufacturers in the region is unstable, the ex-factory quotation has dropped slightly, the terminal downstream and traders mostly maintain rigid demand for replenishment, and the market transaction atmosphere has not significantly improved. At present, the fundamentals of methanol are not obviously favorable for the time being. From the point of view of the port market, in this cycle, the inventory in the port area increased significantly compared with the previous period, the start-up of the downstream olefin plant maintained a low shock, the demand for methanol was poor, and with the arrival of imported shipments, the inventory in the region increased. At present, there is no obvious positive support in the mainland market in the short term, and it is expected that the short-term methanol market price will continue to be weak and volatile, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.

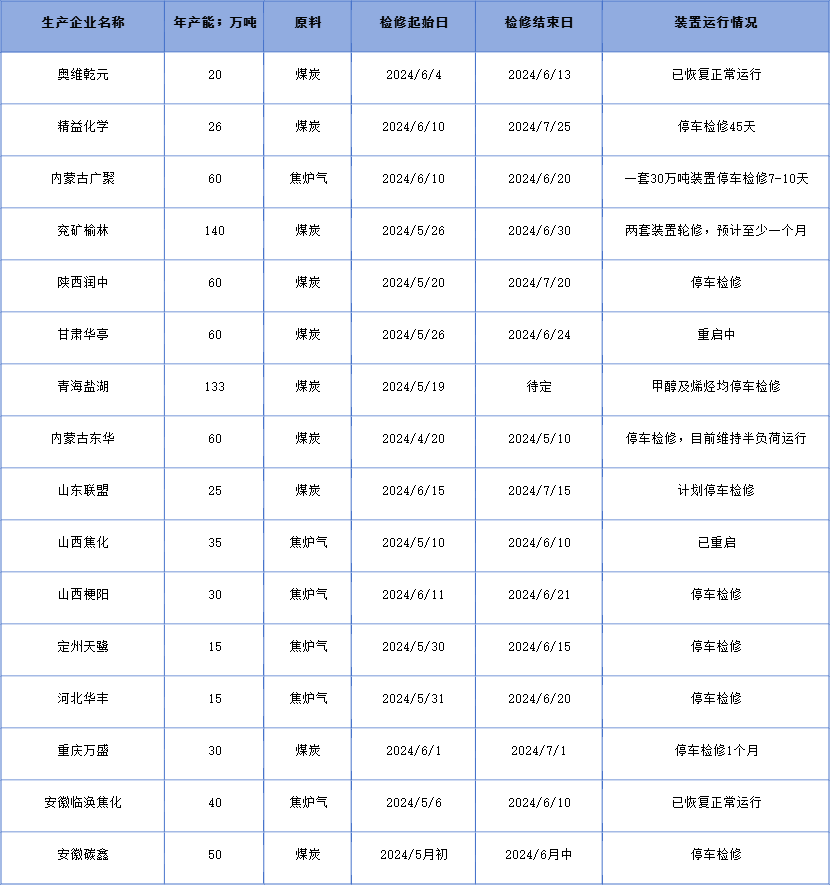

Recent operation of the plant