Daily Review of Urea: Print sentiment impacts the market and prices are firm and rising in the short term (June 26)

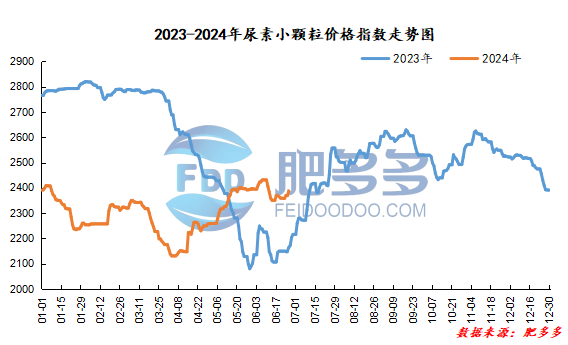

Domestic urea price index:

According to calculations from Feiduo data, the urea small pellet price index on June 26 was 2,387.41, an increase of 18.64 from yesterday, a month-on-month increase of 0.79% and a year-on-year increase of 10.33%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2130, the highest price is 2147, the lowest price is 2118, the settlement price is 2132, and the closing price is 2135. Compared with the settlement price of the previous trading day, the month-on-month increase is 1.14%. The fluctuation range of the whole day is 2118-2147; the basis of the 09 contract in Shandong is 195; the 09 contract has reduced its position by 1438 lots today, and so far, the position is 214856 lots.

Urea futures prices are generally operating strongly today, but the closing price is lower than yesterday. The market sentiment driven by the news of the printing bid is still warm but its persistence is doubtful. Under the market's rational state, there is limited momentum to continue to move upwards. However, the recovery of market atmosphere and macro sentiment in the short term will still support prices. The positive feedback from the spot market may continue. In the short term, urea itself may still be mainly affected by market environment and mood fluctuations under the premise of limited changes in fundamentals.

Spot market analysis:

Today, domestic ureamarketPrices have risen more and more. Under the influence of emotions, new orders have increased in the market. However, as prices rise, operators continue to follow suit and wait and see, and the market is operating firmly.

Specifically, prices in Northeast China rose to 2,470 - 2,490 yuan/ton. Prices in East China rose to 2,280 - 2,360 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,280 - 2,460 yuan/ton, and the price of large particles rose to 2,260 - 2,310 yuan/ton. Prices in North China rose to 2,180 - 2,500 yuan/ton. Prices in South China rose to 2,360 - 2,460 yuan/ton. Prices in Northwest China rose to 2,410 - 2,430 yuan/ton. Prices in Southwest China have stabilized at 2,260 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, after the market situation has increased, the transactions of new orders by mainstream regional companies have improved again, and the transaction volume has increased significantly. Manufacturers 'quotations have risen firmly, and the number of new orders has increased. The number of new orders has not stopped. Currently, goods are being shipped one after another. In terms of the market, the announcement of the printed mark has driven the trading atmosphere to warm up, and the number of new orders in the market has continued to increase. However, as prices continue to increase, it is not ruled out that downstream resistance will intensify. It is expected that the market will stabilize after a short period of time, and the market will be deadlocked. Volatility consolidation is the main focus. On the supply side, the increase in daily supply is slow. This week, some maintenance equipment will be restored. Spot supply will gradually relax, and the industry's daily output will rebound. On the demand side, the domestic demand for a small amount continues to be followed up, and the front line for agricultural fertilizer preparation has been affected by the drought has lengthened. As prices rise again, agricultural procurement has gradually slowed down, and production and sales have been flexibly adjusted to follow up and reduce the amount.

On the whole, the current urea market is driven by the printed label, and trading sentiment on the market is high. It is expected that the urea market price will continue to rise slightly in the short term due to the impact of the printed label.