Urea Daily Review: Indian bidding information released boosts domestic market sentiment (June 25)

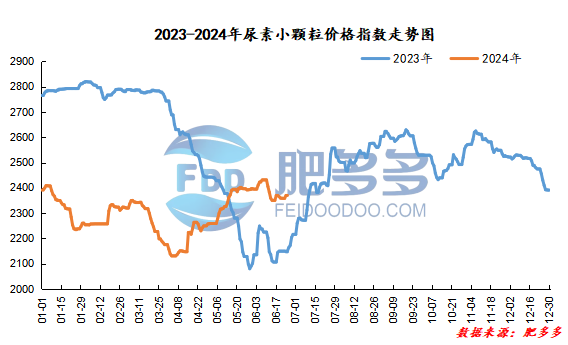

Domestic urea price index:

According to Feiduo data, the urea small pellet price index on June 25 was 2,368.77, a decrease of 0.91 from yesterday, a month-on-month decrease of 0.04% and a year-on-year increase of 10.16%.

Urea futures market:

Today, the opening price of urea UR409 contract: 2085, the highest price: 2145, the lowest price: 2083, the settlement price: 2111, the closing price: 2145. The closing price increased by 70% compared with the settlement price of the previous trading day, up 3.37% month-on-month, and the fluctuation range throughout the day is 2083-2145; the basis of the 09 contract in Shandong is 145; the 09 contract has increased its position by 14615 lots today, and so far, it has held 216294 lots.

Urea futures prices rose sharply today, mainly driven by market sentiment due to the news of printing and bidding. Although whether subsequent export policies will support them remains to be considered, due to the absence of the Chinese market, the supply in the international market has decreased and the expected growth in bidding demand has continued to raise international prices, there is still a strong stimulus to domestic prices. Changes in the international market and export policy issues can be observed in the short term.

Spot market analysis:

Today, domestic ureamarketPrices have been stable and low. After the company's acquiring quotations have been revised back, the downstream willingness to follow up has weakened, and the market operation has been deadlocked.

Specifically, prices in Northeast China have stabilized at 2,440 - 2,490 yuan/ton. Prices in East China rose to 2,260 - 2,320 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,250 - 2,460 yuan/ton, and the price of large particles has stabilized at 2,260 - 2,280 yuan/ton. Prices in North China have stabilized at 2,160 - 2,460 yuan/ton. Prices in South China are stable at 2,350 - 2,460 yuan/ton. Prices in the northwest region are stable at 2,380 - 2,400 yuan/ton. Prices in Southwest China have stabilized at 2,260 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, after the factory quotation was raised yesterday, the follow-up of new downstream orders slowed down. Currently, among manufacturers who are successively shipping advance orders, sales pressure has eased based on the support of pending orders, and the mentality of supporting prices in the short term is mainly high. In terms of the market, as prices rose, the atmosphere for continued procurement follow-up in the market was slightly general. Today, the market follow-up was dull. New orders were reduced by factories in mainstream regions, and the market situation was deadlocked. In terms of supply, equipment failures have occurred frequently in recent days, and the industry's daily output has been reduced within a narrow range. Currently, the daily output has dropped to below 170,000 tons, and the industry's supply has shrunk slightly. On the demand side, there has been small-scale rainfall in some areas recently, and agricultural demand procurement has been slightly followed up; the construction of industrial downstream compound fertilizer factories is still low, and follow-up on the procurement of raw materials is limited, and short-term demand is generally supported by price. Internationally, India's IPL issued a tender notice for the import of non-quantitative urea last night. The bid opening time is July 8, valid until July 18, and the latest shipping date is August 27. The announcement of the stamp mark may boost the industry's bullish sentiment towards the market to a certain extent, driving up domestic off-season demand.

On the whole, the current operation of the urea market is deadlocked. The bid opening in India may promote the trend of the market. The current mentality of the industry is obviously bullish. It is expected that the urea market price will be driven by the international side or slightly increase in the short term.