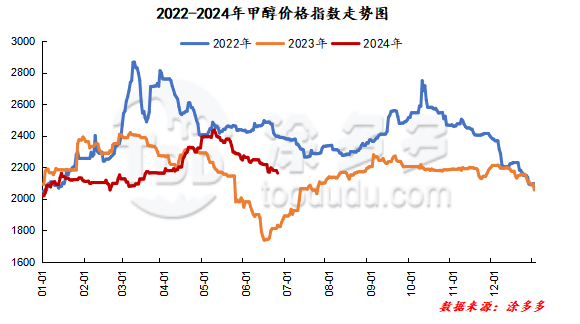

Methanol: Futures market hits new low, spot prices continue to be weak

On June 24th, the methanol market price index was 2162.51, down 16.95 from the previous working day, and 0.78% lower than the previous working day.

Outer disk dynamics:

Methanol closed on June 21:

China CFR 294-297 US dollars / ton, down 3 US dollars / ton

Us FOB 107-108 cents per gallon, down 1 cent per gallon

Us $357-358 per ton in Southeast Asia, Ping

European FOB 320.75-321.75 euros / ton, down 1 euro / ton.

Summary of today's prices:

Guanzhong: 2220-2270 (- 20), North Route: 2050-2070 (- 10), Lunan: 2420-2430 (0), Henan: 2330-2350 (0), Shanxi: 2280-2330 (0), Port: 24802495 (- 15)

Freight:

North Route-North Shandong 250-290 (- 5gammer Mel 10), North Line-South Shandong 350-390 (0max 0), South Line-North Shandong 230-270 (10max 10), Guanzhong-Southwest Shandong 160-200 (0max 0)

Spot marketToday, the price of methanol market continues to run weakly, the futures market refreshes a new low in stages, the lowest price falls to 2475, the price in the port spot market is lowered along with it, the spot basis does not change much, and the negotiation transaction is OK. The mainland market quotation continues to be weak, the current market supply and demand pattern has not significantly improved, some operators in the market still have a certain wait-and-see mood for the future. Specifically, the market prices in the main producing areas are arranged in a narrow range, with quotations on the southern route around 2100 yuan / ton, the northern line around 2050-2070 yuan / ton, and the low end down by 20 yuan / ton, and the bidding prices of the main enterprises fall in a narrow range, but the overall transaction is still mediocre. Downstream and traders are cautious in receiving goods. Shaanxi Shenmu methanol starting price is quoted at 2120 yuan / ton factory cash exchange, the quantity is 3500 tons, all failed auctions. Rongxin today quoted the starting price of methanol at 2050 yuan per ton, with a quantity of 9000 tons, with a partial transaction. Yulin Yankuang methanol starting price today quoted 2100 yuan / ton factory cash exchange, the quantity of 8000 tons, part of the transaction. The market prices in Shandong, the main consumer area, are adjusted in a narrow range, with 2420-2430 yuan / ton in southern Shandong and 2380-2400 yuan / ton in northern Shandong, with futures falling in a narrow range. Today, auction prices in peripheral areas are low and transactions are not good, and the market operators are full of wait-and-see mood. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2340-2350 yuan / ton today. The downstream market demand performance is general, and the overall trading atmosphere in the market is limited. Shanxi quotes 2280-2330 yuan / ton today. At present, the demand side of the downstream continues to be weak. And the methanol market transaction situation in the surrounding areas is poor, and prices fall back, dragging the spot market on the floor, leading to a lack of confidence in business sentiment.

Port marketToday, methanol futures fluctuated after falling. The spot transaction is limited. Paper goods bargain receiving and replacement is active, arbitrage shipments are the main, the basis is strong, the price difference between months to maintain stability. The overall transaction is active. Taicang main port transaction price: 6 deals: 2480-2495, basis 09: 0, base: 2480: 2490, basis: 090, base: 2495: 2505, basis: 09: 15: 17: 8: 2515-2520, basis: 09: 30.

Future forecast:At present, the contradiction between supply and demand in the mainland market is still not significantly improved, the overall supply of negotiable goods in the market is still abundant, and the Huating 600000-ton plant is restarted, the market supply in the region is expected to increase, and the Shenhua Ning coal olefin plant is still in a state of stop. as well as the traditional downstream consumption off-season, the demand side continues to be bearish, and the operators lack confidence in the future. At present, the contradiction between supply and demand in the mainland market still exists, coupled with the continued weak operation of the futures market, which is a drag on the mentality of the operators, and it is expected that the methanol market price may continue to be weak in the short term, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.