PVC: The low point of the futures price has refreshed and increased positions downward, the market is weak again, and the spot market is running downward

PVC Futures Analysis:June 21 V2409 contract opening price: 6160, highest price: 6175, lowest price: 6094, position: 848377, settlement price: 6134, yesterday settlement: 6158, down 24, daily trading volume: 961611 lots, precipitated capital: 3.62 billion, capital inflow: 12800.

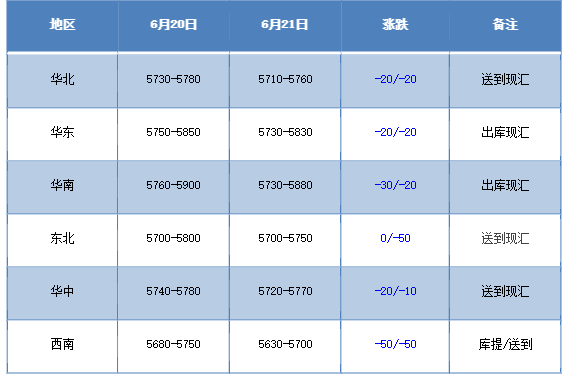

List of comprehensive prices by region: yuan / ton

PVC spot market:The mainstream transaction price of the domestic PVC market has declined, and the market operation atmosphere is poor. Compared with the valuation, it fell by 20 yuan / ton in North China, 20 yuan / ton in East China, 20-30 yuan / ton in South China, 50 yuan / ton in Northeast China, 10-20 yuan / ton in Central China and 50 yuan / ton in Southwest China. The ex-factory prices of upstream PVC production enterprises remain basically stable, coinciding with no obvious price adjustment on Friday, but there are not many contracts signed in the first generation, and the merchants have a heavy wait-and-see mentality. Futures trend is weak, especially further downward in the afternoon, spot market traders can maintain a price offer in the morning, but with the fall of futures prices, market quotations began to decline, which became more obvious in the afternoon. After the futures price goes down, the price advantage is relatively obvious, and the basis offer is not adjusted much, including 09 contract in East China-(280-350-380), 09 contract in South China-(230-300), 09 contract in North China-(580-650), and 09 contract in Southwest China-(450). Although the prices of the two cities fell, they did not usher in a better improvement in transactions, and the operation of the market continued to be weak.

From the perspective of futures:The opening price of PVC2409 contract at night is mainly arranged in a narrow range, and even slightly upwards in late trading. But after the start of morning trading, futures prices began to decline from their highs, and afternoon prices weakened further. 2409 contracts fluctuated in the range of 6094-6175 throughout the day, with a spread of 81 .09 contracts with an increase of 37618 positions, with 848377 positions so far, 2501 contracts closing at 6255 and 119295 positions.

PVC Future Forecast:

In terms of futures:The volatility low of PVC2409 contract futures was refreshed again, breaking the trend of low sideways and further downward, and the downside short opening was relatively obvious. In terms of trading, the short opening was 25.7% higher than that of 23.7% higher. The suppression of short opening led to the obvious weakness of afternoon futures prices and closed at the low in late afternoon trading. The technical level shows that the three tracks of the Bolin belt (13, 13, 2) all turn downward, and the low point approaches the position of the lower rail. The KD line and MACD line at the daily level continue to show a dead-end trend, and the weak operation of the futures price breaks the market atmosphere, which weakens the atmosphere of the two cities. At present, there are not many factors from the policy side, in the short term, the trend of futures prices or continuous testing is the main way to observe the performance in the range of 6070-6180.

Spot aspect:First of all, from the perspective of overall commodity sentiment, at the close of midday trading, the main domestic futures contracts fell more and rose less. Lithium carbonate fell by more than 2%, while coke, coking coal, iron ore, Shanghai lead, ferrosilicon, Douer, vegetable oil and Shanghai nickel fell by more than 1%. Under the weak mood, it is also difficult for PVC to be alone, and there is an obvious weakening trend in the two cities. Changed yesterday's good mood, the spot market coincides with Friday, although the price downside point price has an advantage, but the transaction is light, downstream products enterprises wait-and-see mentality is heavier, and hang order point is lower, except for rigid demand replenishment there is no obvious improvement in trading, the supply and demand level still maintains the early stage. In the outer disk, the price of international crude oil futures market rose as official data showed that US crude oil inventories fell last week, but the stronger dollar limited the rise in oil prices. At the same time, geopolitical tensions continue to increase market risk appetite. The geopolitical risks posed by the Gaza crisis could increase the risk of oil supply disruptions in major oil-producing areas. Overall, the spot price of PVC may still be hovering at a low level in the short term.

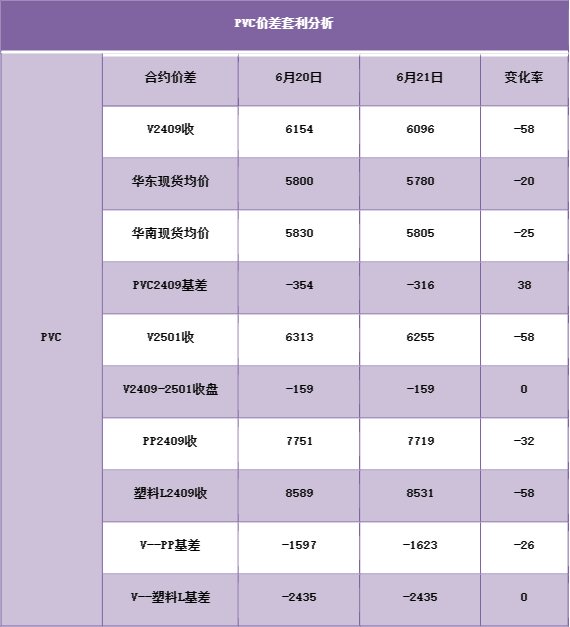

PVC spread arbitrage analysis: