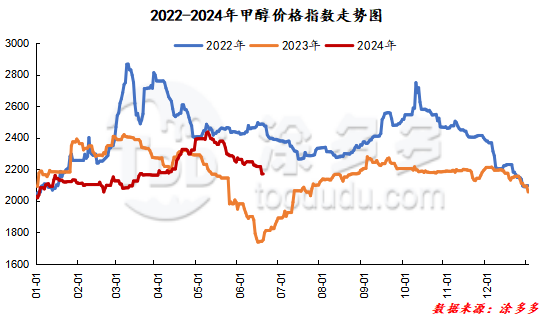

Methanol: Futures range fluctuates and spot market adjusts within a narrow range

On June 18, the methanol market price index was 2168.66, down 1.73 from yesterday and 0.08 per cent lower than yesterday.

Outer disk dynamics:

Methanol closed on June 17:

China's CFR is US $295308 / ton, down US $6 / ton

Us FOB 108-109 cents per gallon, up 3 cents per gallon

Southeast Asia is closed.

European FOB 324.75-325.75 euros / ton, down 2 euros / ton.

Summary of today's prices:

Guanzhong: 2280-2300 (0), North Route: 2050-2080 (0), Lunan: 2410 (0), Henan: 2360-2385 (- 10), Shanxi: 2270-2340 (0), Port: 2505-2515 (5)

Freight:

North Route-Northern Shandong 275-330 (0ram 0), Northern Route-Southern Shandong 350-390 (0amp 0), Southern Route-Northern Shandong 260-290 (0max 0), Guanzhong-Southwest Shandong 160-210 (0max 0)

Spot market: today, methanol market prices continue to be weak and volatile. At present, the performance of terminal downstream market demand is still poor, and some operators in the market are not enthusiastic about buying under the influence of the mentality of buying up or down. After the new prices of some manufacturers are reduced, the shipments are still general, and the operators have a strong wait-and-see mood. Specifically, the market prices in the main producing areas are arranged in a narrow range, with the quotation on the southern line around 2150 yuan / ton and the northern line around 2050-2080 yuan / ton, with a stable low end, the spot market supply remains abundant, and the market center of gravity in the region has fallen somewhat. Downstream is not enthusiastic about receiving goods under the influence of the mentality of buying up but not buying down. The market price in Shandong, the main consumer area, is weak, with 2410 yuan / ton in southern Shandong and 2360-2380 yuan / ton in northern Shandong, with a reduction of 20 yuan / ton at the low end. today, the methanol futures market is slightly up, boosting the mentality of operators in the market, coupled with smooth trading at external auctions. the market turnover in the region has improved slightly. The market quotation in North China is adjusted narrowly. Hebei quotation is 2380 yuan / ton today. The inventory pressure of enterprises in the region is not great. Under the support of low storage, the manufacturers' price-raising sentiment is not reduced, but the market demand side has not been significantly improved, and the market transaction atmosphere is not good. Shanxi quotes 2270-2340 yuan / ton today, the downstream product industry has entered the off-season, downstream replenishment still maintains rigid demand.

Port market: methanol futures fluctuated in a narrow range today. In the middle of the month, rigid demand to receive goods; long-term small shipments every high, arbitrage buy mostly, the basis to maintain stability, the transaction is general. Taicang main port transaction price: spot / 6: 2505-2515, base difference 09-13 prime price: 2505-2515, basis difference 09-10 prime price 7 transaction price: 2520-2530, basis difference 09pm 5pm 8.

Future forecast: recently, the Chinese market quotation is weak and volatile under the influence of the prominent contradiction between supply and demand, some olefin plant raw materials on the market continue to be exported, the supply in the region is still abundant, the performance of market demand downstream of the terminal is poor, the overall trading volume of the market is limited, and some operators in the market hold a certain wait-and-see mood towards the future. From the point of view of the port market, with the arrival and unloading of imported shipments, the supply of negotiable goods in the port market has increased, and the spot spread continues to weaken, which does not support the Chinese market. At present, it is expected that the livestock market will continue to operate weakly in the short term under the influence of the contradiction between supply and demand, and the overall trading volume of the market may be relatively limited, but in the later stage, we should pay attention to the coal price, the operation of on-site equipment and the follow-up of downstream demand.

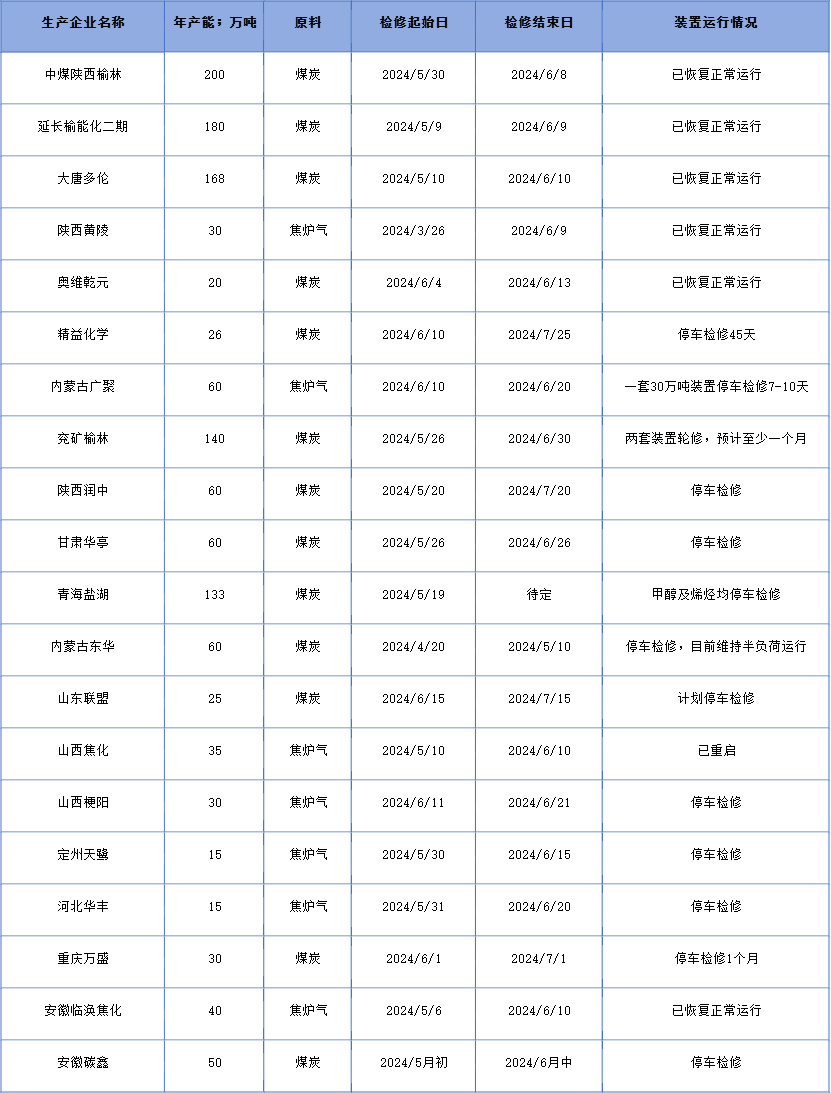

Recent operation of the plant