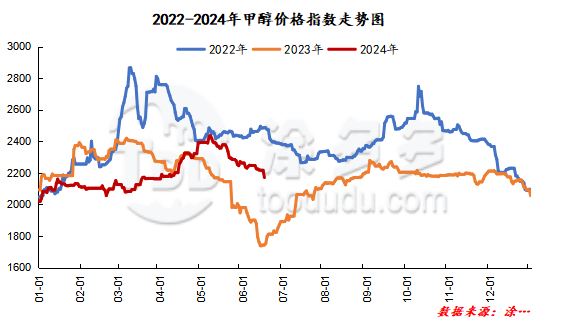

Methanol: The methanol period is now volatile and downgraded, and the industry has obvious wait-and-see attitude

On June 17, the methanol market price index was 2170.39, down 46.16 from the previous working day, and 2.08 per cent lower than the previous working day.

Outer disk dynamics:

Methanol closed on June 14:

China CFR 302-308 US dollars / ton, down 2 US dollars / ton

Us FOB 105-106 cents per gallon, up 2 cents per gallon

Southeast Asia CFR 363.5-364.5 US dollars / ton, Ping

European FOB 326.75-327.75 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2280-2300 (- 20), North Route: 2050-2100 (- 60), Lunan: 2410 (- 70), Henan: 2370-2380 (- 10), Shanxi: 2270-2350 (0), Port: 2500-2525 (- 45)

Freight:

North Route-North Shandong 275-330 (5amp 10), North Line-South Shandong 350-390 (0amp 10), South Line-North Shandong 260-290 (0amp 0), Guanzhong-Southwest Shandong 160-210 (10max 0)

Spot market: today, methanol market prices are arranged in a narrow range, methanol from individual olefin plants in the main producing areas continues to be exported, and the spot market supply remains loose. At present, the downstream market demand is limited to maintain rigid demand procurement, and some traders return to a narrow price range. Specifically, the market price in the main producing areas is arranged in a narrow range, with the quotation on the southern line around 2150 yuan / ton, the low end down by 30 yuan / ton, and the north line around 2050-2100 yuan / ton, and the low end by 60 yuan / ton. at present, the spot supply in Inner Mongolia and Shaanxi remains abundant, and the quotations of some manufacturers fall narrowly under the shipping demand, but the downstream still maintains rigid demand procurement, the transaction is general. The market price in Shandong, the main consumer area, is weak, with 2410 yuan / ton in southern Shandong and 2380-2400 yuan / ton in northern Shandong. The futures market is weak and volatile, and the downstream market is in the off-season. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2380 yuan / ton today, but the follow-up in the lower reaches of the region is limited. Some operators in the market hold a certain wait-and-see mood for the future, and the price of manufacturers fluctuates little. Shanxi quotes 2270-2350 yuan / ton today. The overall trading atmosphere of the market is slightly general, paying attention to tomorrow's market auction.

Port market: methanol futures are weak and volatile today. The shipping offer is positive, the delivery is cautious, the basis continues to weaken, and there is a discount within the month; the idea of replacement continues, and the price difference expands slightly. The overall deal is OK. Taicang main port transaction price: spot transaction: 2510-2525, basis 09-0Universe 5, transaction 6: 2500-2515, basis 09-12, base 09-8, basis 09-8, basis 09-8, margin 10, transaction 8, transaction: 2540-2545, basis 09-2545, basis 09-2515, basis 09-8, basis 09-10, basis 09-2545, basis 09-8, basis 09-10, basis 09-2545, basis 09-10, basis 09-2545, basis 09-8, basis 09-10, basis 09-2545, basis 09-

Future forecast: at present, the spot market price of methanol shows a fluctuating trend, the arbitrage space between China and the port continues to narrow, and most operators still hold a wait-and-see mood in the future, in addition, some of the traditional downstream has entered the off-season of consumption. the market demand end has limited support for methanol, but at present, the cost end is based on the methanol market price, and the daily consumption of terminal power plants has increased slowly in the near future. The temperature in the southern region does not promote the electricity demand sufficiently, the power plant does not have a large amount of coal demand in the purchasing market for the time being, the non-electricity market maintains the rigid demand, and the demand side can support the coal price. It is expected that the coal price will operate stably in the short term, and the short-term cost side can support methanol. At present, it is expected that the short-term methanol market price will continue to fluctuate, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.

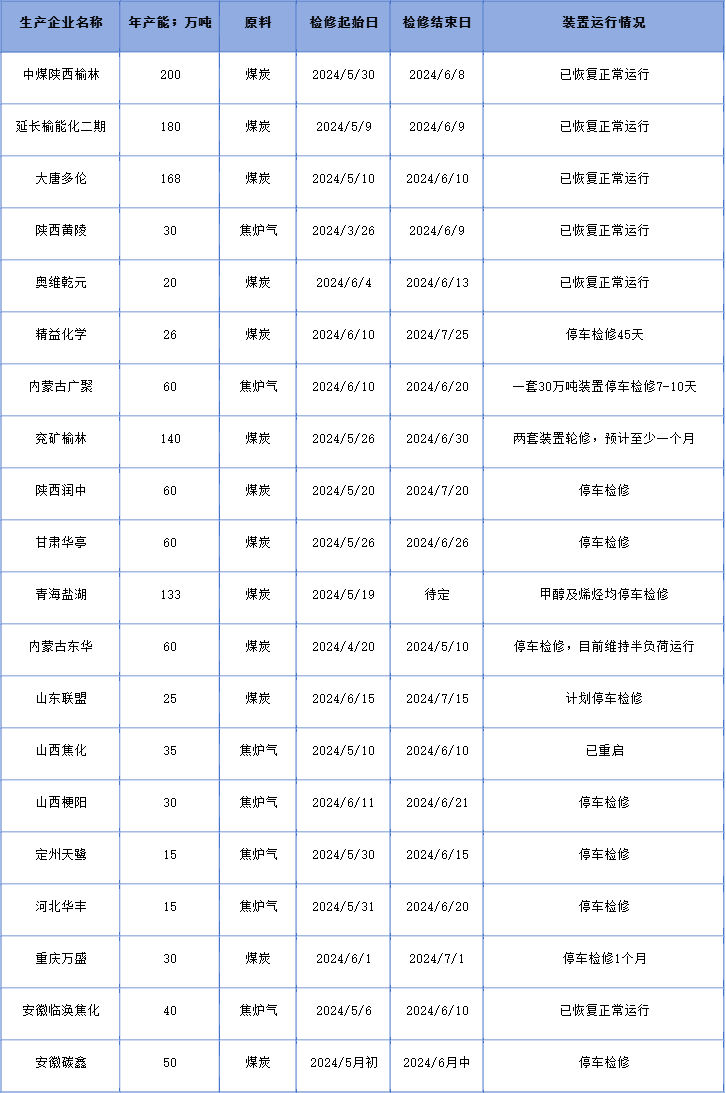

Recent operation of the plant